Financial services company Hargreaves Lansdown (GB:HL) issued its first-quarter trading update along with news of its chief executive Chris Hill stepping down from his role – and the company’s stock plunged, trading down by 6% during the day.,

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

It has fallen by 38% in the year so far.

Hill has spent more than six years at the company, initially joining as a chief financial officer in 2016. He will remain with the company until November 2023 as the search for his successor remains on.

During his tenure, the company has seen a huge growth in terms of both assets and clients, which have more than doubled.

Analysts at J.P. Morgan said, “The departure of the CEO will raise questions on whether a new CEO might decide to lower Hargreaves Lansdown fees, which would make it regain competitiveness, but with short-term substantial headwinds to revenues.”

The company posted a jump of 15% in revenues of 162.9 million. The assets under administration (AUA) were at £122.7 billion, down from £123.8 million in June 2022, reflecting adverse market movements.

Despite the challenging economic conditions, HL added £700 million of new business and active client growth of 17,000 clients, driven by its superior platform and new clients in SIPP, ISA, and active savings accounts.

The company increased its margin guidance for the year as it remained focused on cost control measures. The revenue margin guidance for 2023 is increased to 49-52 bps and the cash margin to 130-150 bps.

Hargreaves Lansdown share price forecast

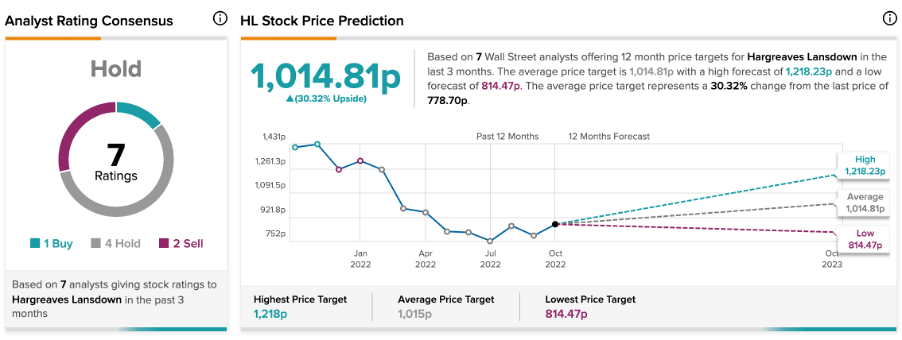

According to TipRanks’ analyst consensus, Hargreaves Lansdown stock has a Hold rating.

The HL target price is 1,014.8p, which is 33.3% higher than the current level.

Conclusion

The company managed to put up a good show in its trading update despite current turbulence in the markets. Shareholders are concerned about whether the next CEO will sustain the company’s current performance.