Energy products and services provider Halliburton (NYSE: HAL) has suspended business operations in Russia, effective immediately. The decision complies with the U.S. government’s sanctions against Russia following the transcontinental country’s invasion of Ukraine on February 24.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The Texas-based company stopped all shipments of some sanctioned parts and products to Russia a few weeks ago. Halliburton does not have any active joint ventures in the invading nation.

Halliburton Chairman, President, and CEO Jeff Miller said, “Since the start of this conflict, we prioritized employee safety and compliance with all relevant sanctions.”

About Halliburton

Halliburton provides services and products to the energy industry related to the exploration, development, and production of oil and natural gas. It has over 40,000 employees working in more than 70 countries.

HAL stock is currently up more than 4% today.

Wall Street’s Take

Overall, the stock has a Strong Buy consensus rating based on 10 Buys and three Holds. The average Halliburton price target of $34.38 implies 8.6% downside potential. Shares have gained around 85% in the past six months.

Investor Opinions

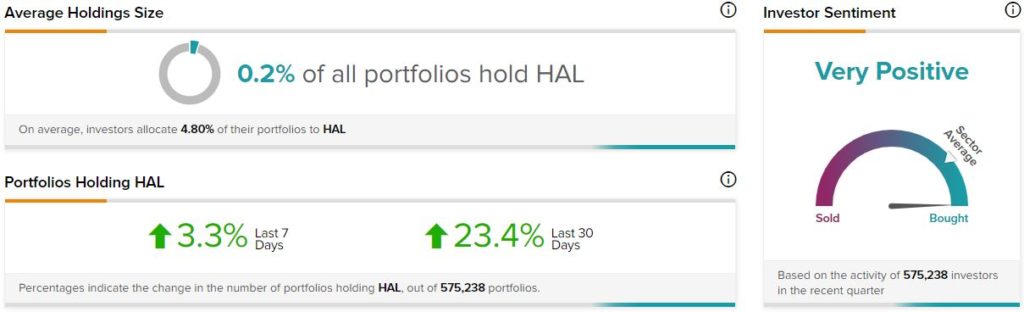

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Halliburton, with 23.4% of investors on TipRanks increasing their exposure to the stock over the past 30 days.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

FDA Approves Bristol Myers Squibb’s Opdualag Therapy

Brookfield Expands Footprint in Australia With $1.1B La Trobe Acquisition

General Dynamics Bags $4.5B Contract from National Geospatial-Intelligence Agency