H.B. Fuller (FUL), an adhesive manufacturer, reported mixed results for the fourth quarter. Further, the company’s outlook for Fiscal 2025 remained below analysts’ expectations. As a result, FUL stock declined about 2% in yesterday’s extended trading session.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

In more detail, adjusted earnings per share of $0.92 fell short of analyst expectations of $1.23 and declined 30.3% from the year-ago quarter. H.B. Fuller’s bottom line was hurt by reduced market volume and increased costs associated with the divestiture of its flooring business in December. Meanwhile, Q4 revenue rose 2.3% to $923.3 million and came above the consensus estimates of $917 million.

H.B. Fuller CEO Celeste Mastin noted the challenges faced by the company during the quarter, citing an unexpected decline in market volume and delays in managing higher raw material costs.

FUL Issues Cautious 2025 Guidance

H.B. Fuller issued a cautious outlook for Fiscal 2025. The company expects revenue to decline 2% to 4% compared to the same quarter last year. On an adjusted basis, revenue is expected to increase by 1% to 2%. Further, FUL anticipates EPS between $3.90 and $4.20, reflecting a 2% to 9% year-over-year jump.

For the first quarter of 2025, H.B. Fuller forecasts adjusted EBITDA between $105 million and $115 million.

The company is planning to streamline its manufacturing and supply chain operations, aiming to generate annual pre-tax cost savings of about $75 million by Fiscal 2030. To achieve this, the company seeks to reduce its manufacturing facilities from 82 to 55 and North American warehouses from 55 to nearly 10.

Is H.B. Fuller a Buy?

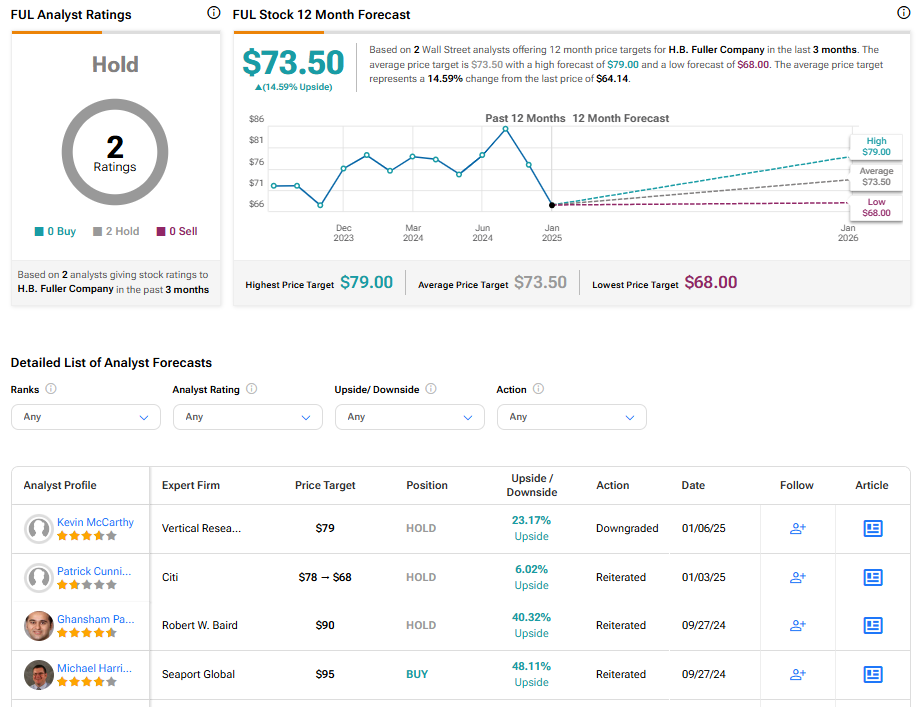

Turning to Wall Street, FUL stock has a Hold consensus rating based on two Holds assigned in the last three months. At $73.50, the average H.B. Fuller price target implies a 14.59% upside potential. Shares of the company have declined 25.17% over the past six months.