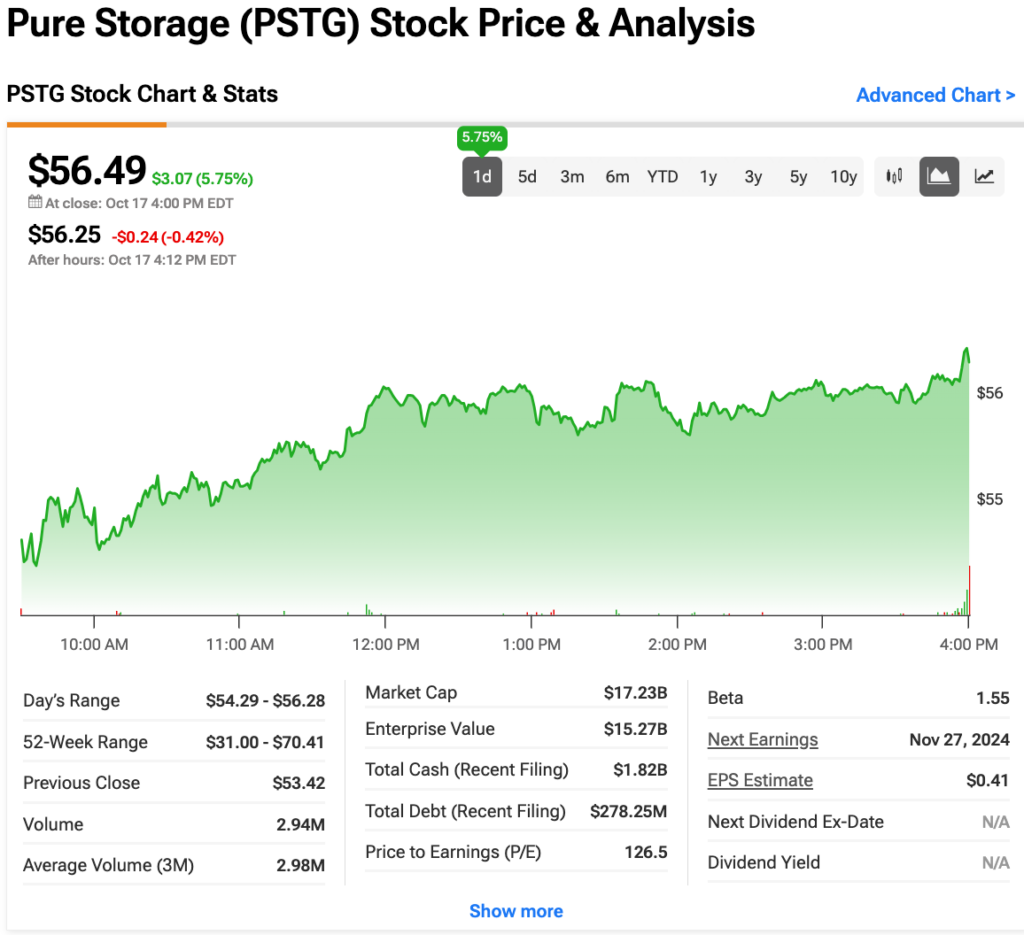

Data storage company Pure Storage (PSTG) finished higher today after Guggenheim praised it as the “best idea.” Analyst Howard Ma also raised his PSTG stock price target from $72 to $93, implying 64% upside potential. This news has helped boost the stock as it continues a year-long trend of mostly growth.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

What’s Happening with PSTG Stock

Pure Storage may sometimes be overshadowed by other companies in the data storage and software spaces. But that doesn’t mean its progress isn’t noteworthy. Indeed, shares have been rising steadily all month, with gains of 14%.

Ma believes that Pure Storage will announce an important deal with a “top 4 hyperscaler” in the coming months. “We’re updating our assumptions for the structure and size of a potential hyperscaler design win for Pure Storage, based on our ongoing due diligence, and are designating Buy-Rated PSTG as our Best Idea” he notes.

The analyst also predicts that the potential hyperscaler deal will drive $3B in aggregate value over the next five years, with a longer contract pushing the number even higher. As his team sees it, Pure Storage would be providing both integrated software and hardware as part of the partnership.

Is Pure Storage Stock a Buy, Sell, or Hold?

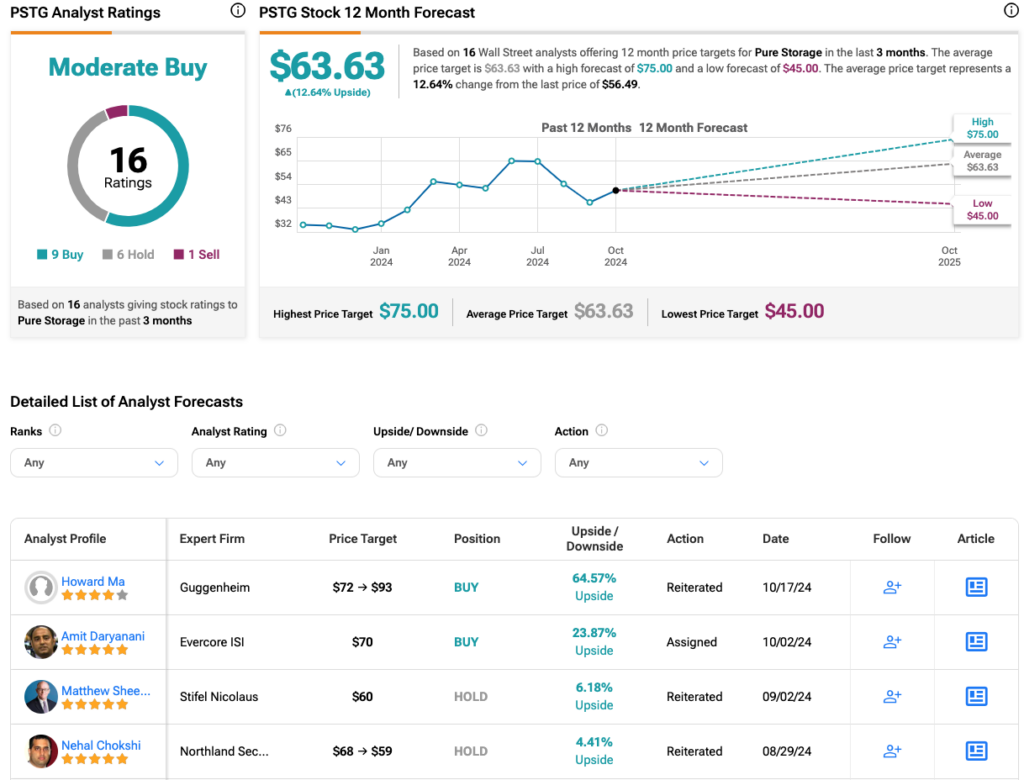

Ma isn’t the only expert who remains bullish on Pure Storage. Analysts have a Moderate Buy consensus rating on PSTG stock based on nine Buys, six Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 60% rally in its share price over the past year, the average PSTG price target of $63.63 per share implies 12.64% upside potential.

As of now, there is no confirmation that Pure Storage has a hyperscaler deal in progress. But even if it does not, the company’s price strength is improving, indicating that the stock has the potential to continue trending upward.