Goldman Sachs (NYSE:GS) and Morgan Stanley (NYSE:MS) are two heavyweights within the investment banking scene that stand out as potential so-called “downstream” winners from the continued rise of generative artificial intelligence (gen AI). Though an argument could be made that any non-tech firm stands to benefit as the productivity benefits from AI gradually trickle down, I view Goldman and Morgan Stanley as two firms that could make the most of AI far sooner than other firms in the financial sector.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Given this and their rich but not unreasonable valuations, I’m inclined to be bullish on GS and MS stock for the year ahead.

Indeed, it’s not just the AI hardware and software companies that value investors should be thinking about if they seek “hidden” or overlooked AI upside. Next-generation tech (specifically gen AI) will play a massive role in shaping the future of the financial industry. And perhaps there’s no established financial powerhouse in better shape to capitalize on the opportunity ahead.

Investment Banking Heavyweights with Serious Tech Prowess

Arguably, Goldman and Morgan Stanley are tech-savvier than most other traditional banks that have been a tad slow at the wheel to embrace the technological sea shift in the financial scene. If anything, both firms may be viewed as fintech companies, given their impressive internal AI assistants and other tech-savvy initiatives (cybersecurity) that could help lead to long-lasting fundamental improvements.

All things considered, it’s not a mystery why most analysts have Buy ratings on shares of GS and MS, especially as they lead the charge in the war for tech talent.

Notably, Goldman Sachs boasts 9,000 developers strong. Morgan Stanley is no slouch, either, with its own Montreal-based tech hub home to around 1,200 technologists. That’s a lot of tech talent for a bank. Perhaps in the future, tech workers and data scientists will vastly outnumber financial pros like traders, bankers, and advisors.

Now, let’s check Tipranks’ Comparison Tool to see how the two financial juggernauts compare and how they stand to be downstream AI winners.

Goldman Sachs (NYSE:GS)

Goldman Sachs stock is up 25% year-to-date, and the stock just hit new highs. With a rather lofty 18.6 times price-to-earnings (P/E) multiple, miles ahead of its past-year range, Goldman needs to go above and beyond to keep its scorching rally going strong.

Recently, Goldman stock got slapped with a downgrade to Neutral from Buy, courtesy of Bank of America Securities analyst Jim Mitchell. As you’d imagine, the valuation was a major reason behind the move. Indeed, many positives in Mitchell’s original bull thesis, like the “capital markets recovery,” are now priced in.

Perhaps Goldman’s new GS AI Platform and the “downstream” AI benefits could help Goldman sustain its premium multiple. Though analysts like Mitchell may overlook such benefits, I do think they’re worth consideration, especially as the investment bank better tailors AI products over time, potentially leaving less-tech-savvy rivals behind in the dust.

The company’s GS AI Platform performs a wide range of tasks, from generating code to summaries and other financial reports. Additionally, Goldman is making good use of Microsoft (NASDAQ:MSFT) GitHub Copilot, which reportedly enhances coder productivity in the ballpark of 20%.

What Is the Price Target for GS Stock?

GS stock is a Strong Buy, according to analysts, with 15 Buys and four Holds assigned in the past three months. The average GS stock price target of $473.18 implies 0.77% downside potential.

Morgan Stanley (NYSE:MS)

Morgan Stanley hasn’t been nearly as hot as Goldman in recent years, still down 6% from its 2022 all-time high. Still, the stock is just as pricy as Goldman, at 18.7 times trailing P/E, a hair more than its investment banking rival. Like Goldman, Morgan Stanley seems to be in a race to augment its employees with generative AI.

Recently, the firm announced that its wealth advisors will get a big AI boost with a ChatGPT-powered assistant named Debrief to help with some of the more tedious duties. It will be interesting to see how much more productive its employees will be once equipped with the well-tailored tech. Given the in-house tech talent, my guess is that Debrief will become markedly better after receiving internal feedback from users.

Either way, considerable cost savings may just grant Morgan Stanley the sustained margin boost it needs to command its current elevated multiple, which, like Goldman, is also on the high side of the past-year range.

What Is the Price Target for MS Stock?

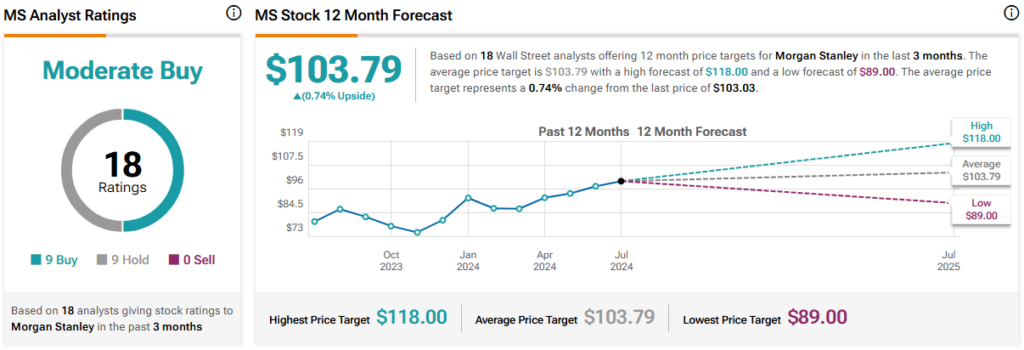

MS stock is a Moderate Buy, according to analysts, with nine Buys and nine Holds assigned in the past three months. The average MS stock price target of $103.79 implies 0.7% upside potential.

Conclusion

Goldman Sachs and Morgan Stanley aren’t exactly AI plays, but each firm recognizes the profit-driving potential of embracing the technology sooner rather than later. With plenty of tech talent, tailored AI assistants, and a laser focus on driving efficiencies, perhaps the rich multiples on GS and MS are well-deserved as the AI’s benefits begin to lift some of the boats further down the stream.