Major U.S. banks are warning that stagflation could be on the horizon after the U.S. Federal Reserve warned of slowing growth and rising inflation.

America’s central bank lowered its economic outlook as part of its latest projections, saying it expects the U.S. economy to grow 1.7% this year, down from a previous forecast of 2.1% growth. At the same time, the central bank raised its inflation outlook, saying core consumer prices are likely to rise at a 2.8% annual pace this year, up from a previous estimate of 2.5%.

Banks such as Goldman Sachs (GS), JPMorgan Chase (JPM), and Bank of America (BAC) used the word “stagflation” to describe the scenario outlined by the U.S. Federal Reserve. Stagflation is a situation where inflation rises even though economic growth slows. It is widely viewed by economists as a worst-case scenario for an economy.

Uncertainty Grows

In a statement accompanying its latest interest rate decision, the Fed said that “uncertainty around the economic outlook has increased.” Fears of an economic slowdown and inflation rising have grown dramatically as U.S. President Donald Trump pursues aggressive import tariffs on key trading partners.

Despite the worsening outlook, the Fed said it still expects to make two interest rate cuts this year, although it cautioned that developments could change quickly in coming months. For now, the U.S. central bank kept its benchmark Fed Funds interest rate unchanged in a range of 4.25% to 4.50%. The central bank is next scheduled to decide on interest rates May 7.

Leading Wall Street firms are warning that markets could be in for a bumpy ride should stagflation appear in the U.S. economy, a development that hasn’t occurred since the early 1980s.

Is GS Stock a Buy?

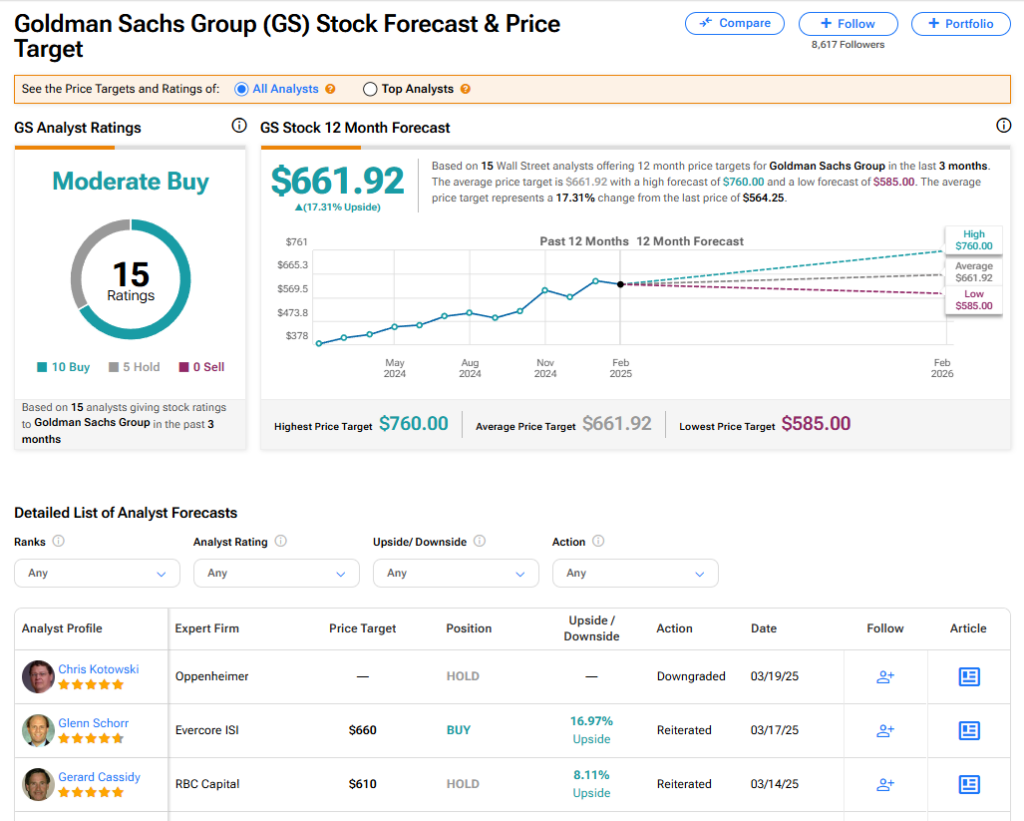

Goldman Sachs stock has a consensus Moderate Buy rating among 15 Wall Street analysts. That rating is based on 10 Buy and five Hold recommendations assigned in the last three months. The average GS price target of $661.92 implies 17.31% upside from current levels.

Read more analyst ratings on GS stock

Questions or Comments about the article? Write to editor@tipranks.com