Shopify (SHOP) stock has more than doubled over the past 12 months, fueled by strong business momentum, expanding profitability, and growing global reach. The company’s core commerce platform continues to thrive, supported by significant gains in both online and offline sales, as well as rapid adoption among business-to-business merchants.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Ongoing innovation in AI-driven tools has enhanced the shopping experience and strengthened merchant performance, while Shopify Payments and Shop Pay have deepened customer loyalty and ecosystem engagement. Success with large enterprise clients and steady international expansion have reinforced Shopify’s leadership in digital commerce, driving renewed investor confidence and sustained market enthusiasm.

Despite trading at premium valuation multiples, I remain Bullish ahead of the company’s upcoming Q3 2025 earnings report next month, given continued market share gains and operational strength.

Strong Q3 Expected to Add Weight to SHOP’s Trajectory

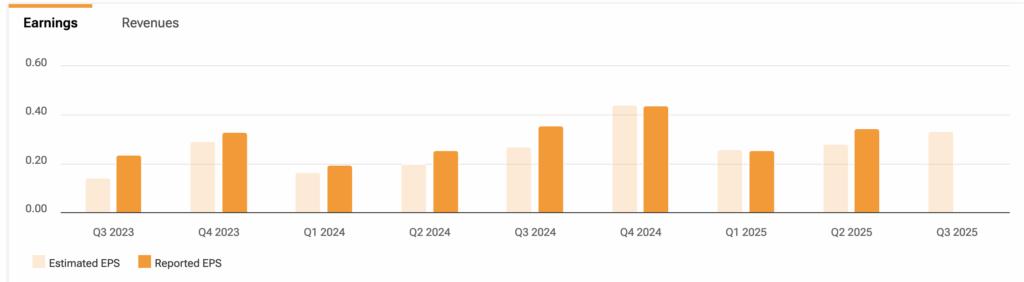

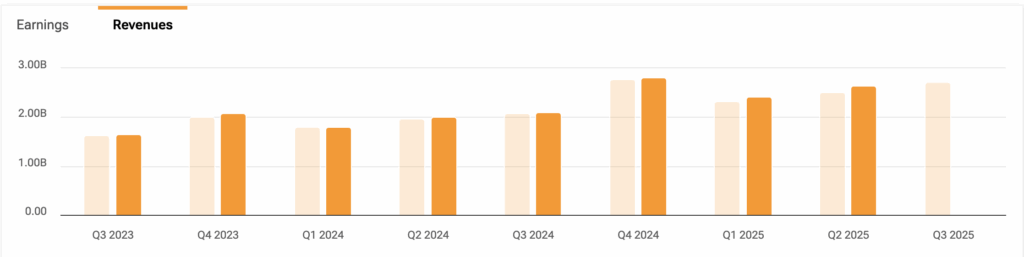

Shopify has beaten both EPS and revenue estimates in 10 of the last 12 quarters, demonstrating reliable execution. The company’s latest Q2 2025 results underscored that consistency — revenue grew 31% year-over-year, while free cash flow margin reached 16%, marking its eighth consecutive quarter of double-digit free cash flow margins.

Wall Street expects Shopify to report EPS of $0.33 and revenue of $2.72 billion for Q3 2025. Over the past year, analysts have raised EPS forecasts by 2.8% and revenue forecasts by 8%, reflecting growing optimism about Shopify’s performance.

During the Q2 call, management guided for revenue growth in the mid-to-high 20% range and gross profit growth in the low 20% range for Q3 — a continuation of the company’s strong trend. I believe Shopify will again outperform those expectations.

Recent e-commerce data supports this view. U.S. online retail sales likely grew 8% year-over-year in September (the same as in July and August), compared with 6.7% in Q2, suggesting a stronger macro tailwind. Based on Shopify’s historical outperformance versus overall U.S. e-commerce, I estimate Q3 GMV rose around 32% year-over-year to $92 billion, comfortably above the $89 billion consensus estimate.

Third-party data also points to healthy platform expansion. Store Leads data shows total Shopify merchants grew 13% year-over-year, with Shopify Plus up 21%, consistent with prior trends. Notably, Shopify gained new enterprise customers, including Dickies, ALDO, and Forever 21. Meanwhile, Apptopia data shows Shop App monthly active users up 29% YoY, signaling rising consumer engagement.

Given this momentum, I expect Shopify to beat consensus on both revenue and EPS and issue stronger-than-expected Q4 guidance — setting the stage for a potentially positive post-earnings reaction.

SHOP’s Margins Make its Premium Valuation Easier to Justify

Shopify’s growth story remains very much intact. The company continues to unlock new monetization opportunities across its ecosystem, fueled by rising adoption of Shopify Payments, Shopify POS, and Shopify Capital. Each of these services strengthens merchant relationships while increasing Shopify’s take rate on gross merchandise volume.

At the same time, the company is steadily improving margins through operating leverage and automation. Although management expects free cash flow margins to hold steady in 2025, long-term expansion appears likely as scale builds. Adjusted operating margins could eventually reach the mid-20% range, driven by AI-enabled efficiency gains, refined pricing strategies, and deeper GMV monetization through new merchant tools.

With a clear trajectory toward greater profitability alongside continued strong growth, Shopify’s premium valuation remains well justified relative to peers.

Premium Valuation Established on Growth

Shopify trades at lofty valuation multiples — but its growth profile justifies the premium. The company’s trailing P/E of ~125x far exceeds the sector median of about 25, and its EV/Sales ratio of about 21 similarly outpaces the industry’s 4. Even so, Shopify’s fundamentals remain outstanding. Revenue growth of nearly 30% year-over-year is more than 4x the sector average, while EBITDA growth of almost 70% towers over its peers.

In fact, across 12 valuation models — including EV/Revenue, Price/Sales, and a five-year DCF with a revenue exit approach — Shopify’s fair value is estimated at ~$130 per share, suggesting roughly 20% downside. Still, strong execution and continued earnings outperformance could sustain the stock’s premium multiple as Shopify continues to outpace the broader market.

What Do the Hedge Funds Think?

Despite its headline-grabbing exploits, the smart institutional money doesn’t seem to like Shopify.

According to TipRanks’ hedge fund tracker, SHOP is currently viewed with low confidence by Wall Street hedge fund managers.

According to 13F filings from 487 hedge funds submitted to the U.S. SEC throughout 2025, as SHOP has seen higher highs, hedge fund managers have reduced their stakes from around 33 million shares in September 2023 to around 19 million today. The current Confidence Signal based on 26 leading hedge funds is Very Negative.

Is SHOP a Good Stock to Buy Right Now?

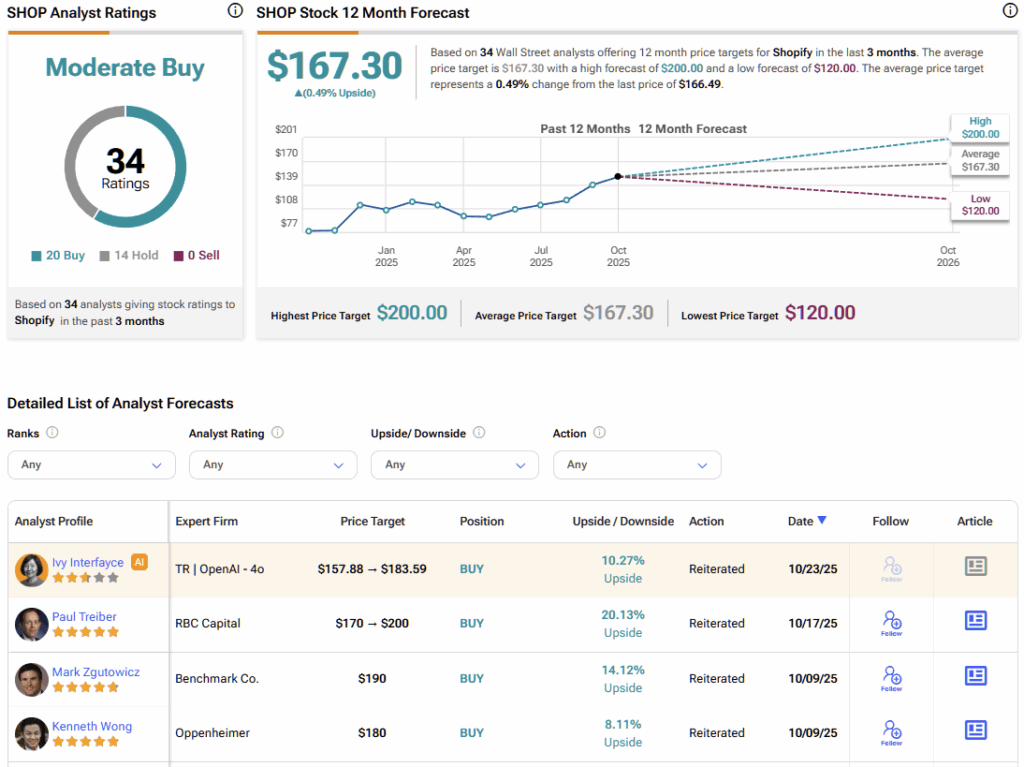

According to TipRanks, Shopify carries a Moderate Buy consensus rating among 34 analysts: 20 Buys, 14 Holds, and 0 Sells. The average stock price target stands at $167.30, implying less than 1% upside over the coming year.

Shopify Poised for Another Beat-and-Raise Quarter

Shopify’s fundamentals remain among the strongest in the e-commerce software space. Accelerating merchant adoption, rising GMV, and expanding operating leverage continue to drive exceptional growth, even at its current scale.

While the stock’s valuation is undeniably rich, Shopify’s consistent execution has historically warranted its premium. With a solid track record of outperforming expectations, ongoing market share gains, and potential upside to Q4 guidance, the company appears well-positioned for another beat-and-raise quarter. For these reasons, I remain bullish on Shopify heading into earnings.