DeepMind, Alphabet’s (GOOGL) AI unit, has placed strict controls over the release of its research papers to maintain its competitive edge in the fast-evolving AI sector, the Financial Times reported. This change marks a departure from DeepMind’s historically open approach to AI research.

The new policies include a six-month delay on some research papers and mandate several approval steps before publishing. This process slows down the researchers from sharing their work.

Former DeepMind scientists have noted that the company is cautious about publishing studies that could benefit rivals or expose flaws in its AI models, such as Google’s Gemini AI.

In its defense, DeepMind said it is committed to growing AI research while keeping a balance between strategy and competition. Also, the company said it still shares hundreds of papers every year and takes part in major AI events.

DeepMind Launches AI for Faster Drug Discovery

In a major update, DeepMind has launched TxGemma, a suite of open AI models designed to make drug discovery faster and cost-effective. These models aim to improve predictions and support multi-step reasoning in therapeutic development, potentially saving years and billions in research costs.

Overall, DeepMind’s products remain in high demand due to their advanced AI capabilities. Its technologies, such as AlphaFold for protein structure prediction and Gemini models for robotics and generative AI, are used in various fields, like healthcare and scientific research.

Is GOOGL Stock a Good Buy?

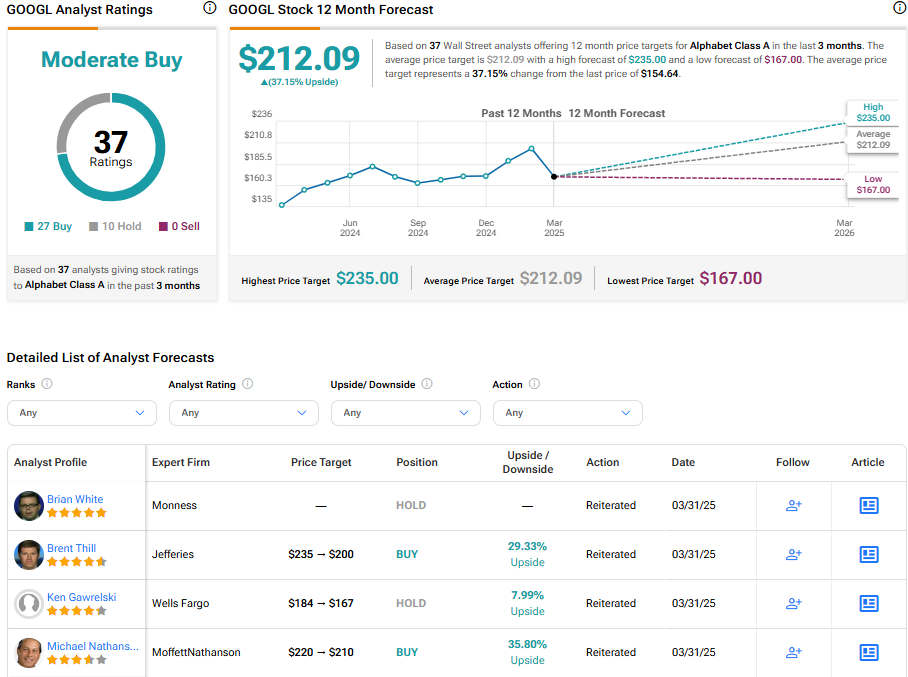

Turning to Wall Street, GOOGL stock has a Moderate Buy consensus rating based on 27 Buys and 10 Holds assigned in the last three months. At $212.09, the average Alphabet stock price target implies 37.15% upside potential. Shares of the company have declined 18.3% in the past three months.