Alphabet (GOOGL) stock has gained 4.2% over the past week as the year-end “Santa Claus” rally propels mega-cap tech to new heights. Despite persistent regulatory headlines throughout December, Google has outperformed the broader market with a 6.8% gain over the past month. Now, JPMorgan (JPM) analysts expect the search giant to surge a further 23% in 2026, citing the explosive growth of Google Cloud and the company’s “full-stack” AI dominance. However, ongoing DOJ antitrust developments and massive capital expenditure requirements remain key variables for investors heading into the new year.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Google Cloud Becomes the AI Ecosystem of Choice

Wall Street was largely blown away by Alphabet’s Q3 2025 results, which marked the company’s first-ever $100 billion revenue quarter. A primary driver was Google Cloud, which saw revenue accelerate 34% year-over-year to $15.2 billion. Analysts have highlighted the staggering $155 billion Cloud backlog, a 46% increase, as a sign of massive “unbilled” demand that will begin to hit the top line in early 2026.

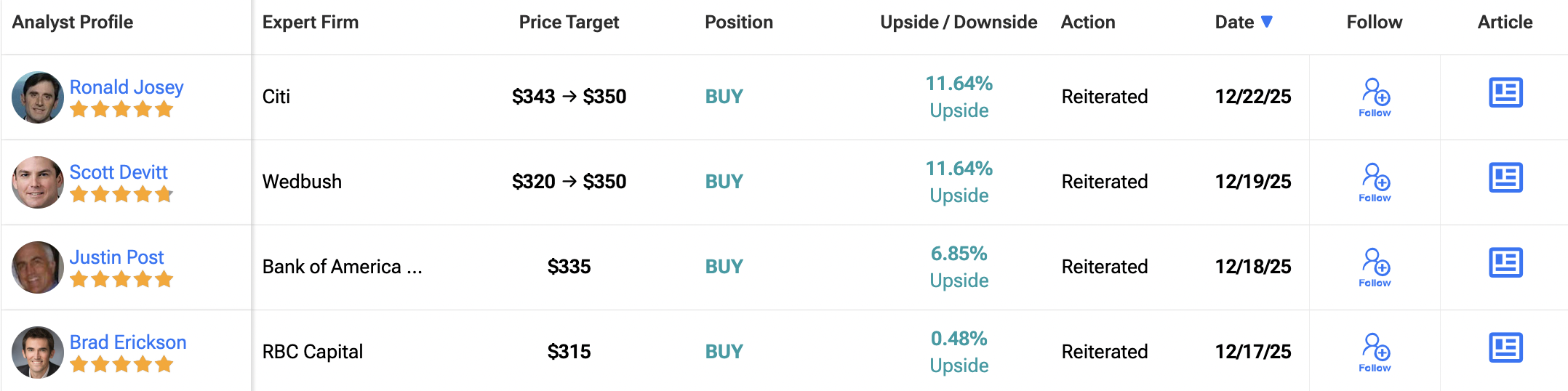

In the latest stock reviews, bullish analysts have lifted Alphabet’s price targets toward the $350-$385 level. JPMorgan recently reiterated its rating on Google’s stock, giving it a $385 price target, implying roughly 23% upside from the current price. These five-star analysts emphasize that Alphabet is the only cloud provider offering a truly integrated stack, from its custom TPU (Tensor Processing Unit) chips to the Gemini model and the search interface itself. Management noted that revenue from products built on Google’s generative AI models grew by more than 200% this year, providing a powerful tailwind for 2026.

Gemini Integration and Waymo Expansion Drive Long-Term Value

Beyond cloud computing, Alphabet is successfully defending its advertising moat. The global rollout of AI Overviews and the new AI Mode in Search have already led to increased query growth, particularly among younger demographics. Analysts believe that as Google introduces ads directly into Gemini conversations in 2026, the company will unlock entirely new revenue streams that could offset any traditional search disruption.

Furthermore, Waymo has transitioned from an “Other Bet” to a legitimate financial catalyst. With a projected $1 billion revenue run rate for 2026 and a valuation approaching $110 billion, the autonomous driving division is finally becoming “meaningful” to Alphabet’s bottom line. Analysts suggest that Alphabet’s ability to internally finance its $110 billion capital expenditure budget through massive free cash flow gives it a significant edge over smaller AI competitors.

Is Alphabet Stock a Buy Before 2026?

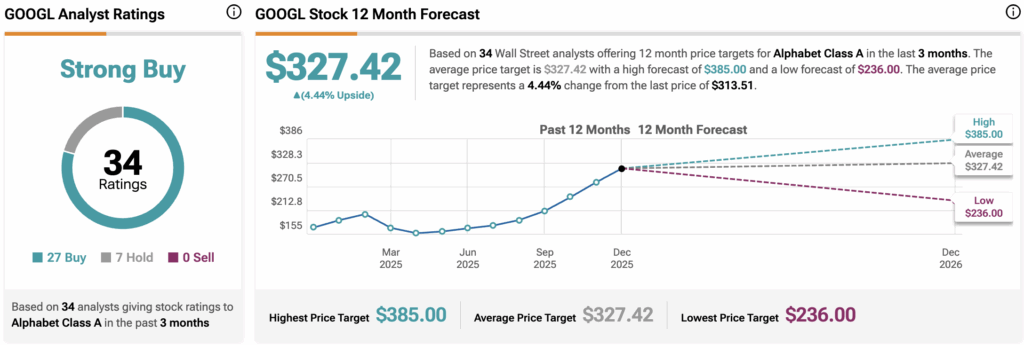

Wall Street remains highly optimistic about Alphabet’s long-term outlook. On TipRanks, GOOGL commands a Strong Buy consensus rating based on 27 Buys and seven Hold ratings. The average GOOGL price target of $327.42 implies 4.44% upside potential from current levels.