The stock of Google parent company Alphabet (GOOGL) is down 4% after privately held OpenAI announced an upcoming product launch that could be a new online search browser.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

OpenAI CEO Sam Altman posted on social media that his startup company will host a livestream on Oct. 21 to launch “a new product I’m quite excited about!” While the post did not explicitly say what the new product is, market speculation is that it will be an internet browser designed to compete directly against Google’s dominant Chrome search engine.

The market reaction reflects rising concerns about potential threats to Alphabet’s core search business. Google’s Chrome browser holds a dominant market share worldwide but could be threatened by a new entrant from OpenAI that integrates artificial intelligence (AI) capabilities to boost online search results.

AI Wars

The judge in the antitrust case against Alphabet decided not to take any punitive measures against the technology giant this past summer because of potential new threats to its search business from AI. Alphabet revised its search results earlier this year, infusing them with more AI as it races to keep up in the ongoing battle over artificial intelligence supremacy.

OpenAI has long threatened to launch its own internet browser to disrupt online search and challenge Alphabet’s dominant position. Google could also face challenges to its near-monopoly position in online search from established players such as Microsoft (MSFT), which runs the Bing browser, and startups such as privately held Perplexity.

Is GOOGL Stock a Buy?

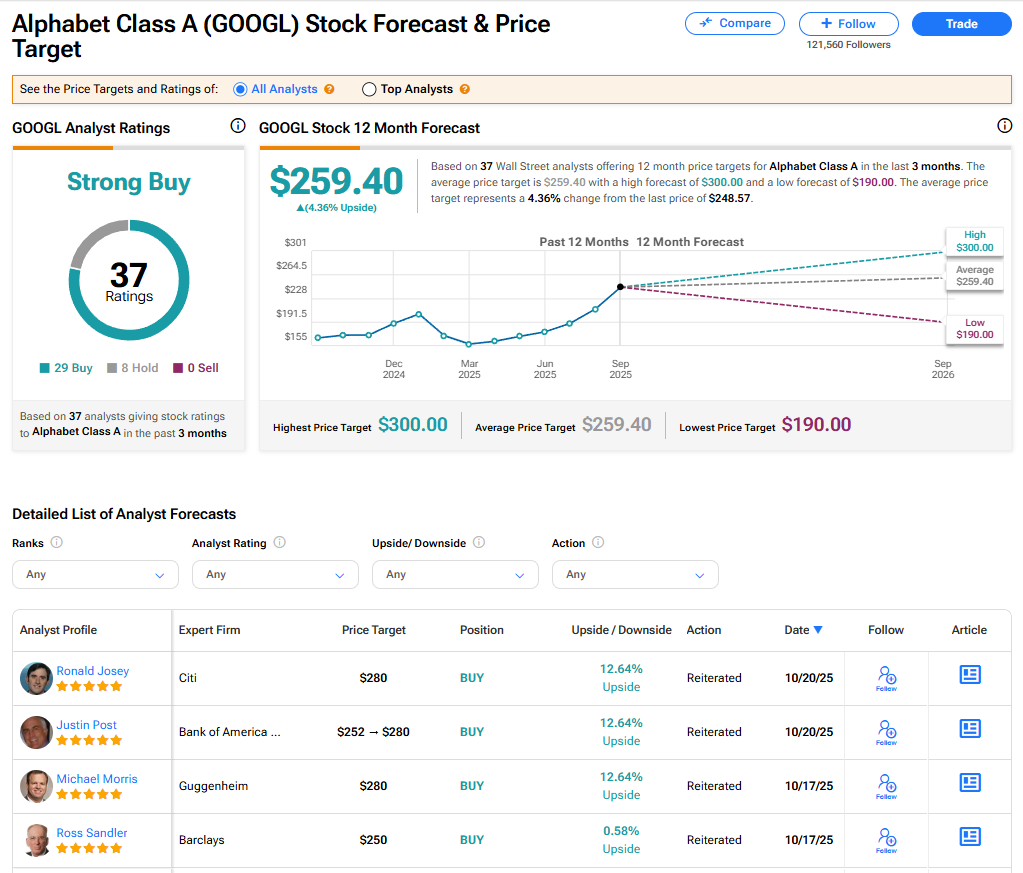

The stock of Alphabet has a consensus Strong Buy rating among 37 Wall Street analysts. That rating is based on 29 Buy and eight Hold recommendations issued in the last three months. The average GOOGL price target of $259.40 implies 4.36% upside from current levels.

Read more analyst ratings on GOOGL stock