Providing a boost to its cloud business, Alphabet Inc. (NASDAQ: GOOGL), the parent company of Google, has agreed to snap up cybersecurity firm Mandiant, Inc. (MNDT) in an all-cash deal worth $5.4 billion.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Shares of Mandiant declined 2% on Tuesday, while shares of Alphabet remained almost flat at the close.

Terms of the Acquisition

Per the terms of the deal, Google will pay $23 for each share of Mandiant. The price tag represents a 57% premium to the undisturbed 10-day trailing volume-weighted average price from Monday. This was the last full trading session before speculation began to shift share prices.

The transaction is likely to close later this year, pending Mandiant shareholders’ approval and certain regulatory approvals. Upon the closure of the deal, Mandiant will be integrated with Google Cloud.

Benefits of the Deal

In the current era of digitization with increasing cyber threats, cybersecurity has become the need of the hour. The cloud aids organizations in protecting themselves against cyber threats, along with enhancing digital transformation through a new parameter of security.

Therefore, Mandiant’s strategic security advisory and incident response services combined with Google Cloud’s cloud-native security offerings will aid enterprises globally to stay protected at all levels.

Additionally, Google Cloud’s existing strengths in security will be complemented by the acquisition of Mandiant, which will enhance offerings with greater capabilities and deliver expertise and intelligence at a larger scale to customers.

Official Comments

Backing up the deal, Google Cloud CEO Thomas Kurian said, “Organizations around the world are facing unprecedented cybersecurity challenges as the sophistication and severity of attacks that were previously used to target major governments are now being used to target companies in every industry.”

Wall Street’s Take

Following the deal announcement, Piper Sandler analyst Thomas Champion maintained a Buy rating on Alphabet and a price target of $3,475. This indicates a 36.7% upside potential from Tuesday’s closing price of $2,542.09 per share.

According to Champion, the deal is a strategic fit for Google, which is expected to complement the Google Cloud platform’s current security offerings, including BeyondCorp Enterprise and VirusTotal.

Shares of Alphabet have shot up 24.6% over the past year. Overall, the stock has a Strong Buy consensus rating based on 30 unanimous Buys. That’s alongside an average Alphabet price target of $3,499, which implies 37.64% upside potential from current levels.

Investors

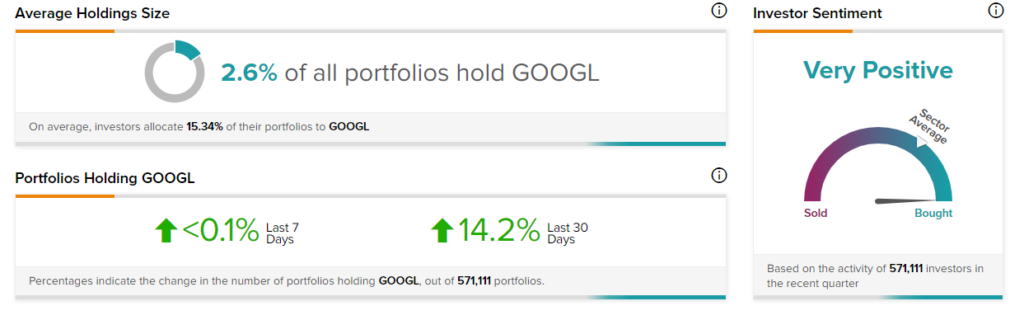

TipRanks’ Stock Investors tool shows that investors currently have an overwhelmingly Positive stance on Alphabet, with 14.2% of investors tracking portfolios on TipRanks having increased their exposure to GOOGL stock over the past 30 days.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

bluebird bio Reports Quarterly Loss, Provides Clinical Updates

Bed Bath & Beyond Jumps over 34% on Cohen’s Stake Disclosure

Citigroup on Hiring Spree, Plans to Expand Global Workforce