Alphabet (GOOGL) has sharply increased patent filings tied to its Tensor Processing Units, which are custom chips built for AI work. According to TrendForce, Google’s TPU patent filings rose 2.7 times from 2018 to 2023, reaching nearly 400 filings in 2023 alone. The data was compiled by Nikkei and tracks patents filed across the U.S., Japan, Europe, and China. By comparison, Amazon (AMZN), Apple (AAPL), and Microsoft (MSFT) each filed fewer than 100 TPU-related patents between 2020 and 2023.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

As a result, TrendForce expects Google to remain the largest TPU shipper among cloud providers.

Annual TPU shipment growth is projected to exceed 40% in 2026, reflecting rising demand for in-house AI chips. More broadly, large cloud firms are building their own chips to reduce cost and lower reliance on Nvidia (NVDA).

Meanwhile, GOOGL shares rose 0.69% on Friday, closing at $315.15.

Production Expands as Customers Show Interest

At the same time, Google’s chip partners Broadcom (AVGO) and MediaTek are increasing reserved capacity at Taiwan Semiconductor Manufacturing Company (TSM). These moves are aimed at supporting higher TPU output over the next several years.

Google’s eighth-generation TPU is expected to enter mass production in the third quarter of 2026 using TSMC’s 3-nanometer process. Production is projected to reach roughly 5 million units in 2027 and 7 million units in 2028, although packaging constraints could limit early output.

Still, outside demand for TPUs is growing. Meta Platforms (META) is in talks with Google to deploy TPUs in data centers starting in 2027, according to Reuters.

Separately, Anthropic reached an agreement in October 2025 to access up to 1 million TPUs, valued at tens of billions of dollars. Notably, the deal allows Anthropic to buy chips directly rather than rely only on cloud rentals.

Taken together, the rise in patents, expanding production plans, and growing customer interest show how Google is steadily turning its AI chips into a broader business rather than a purely internal tool.

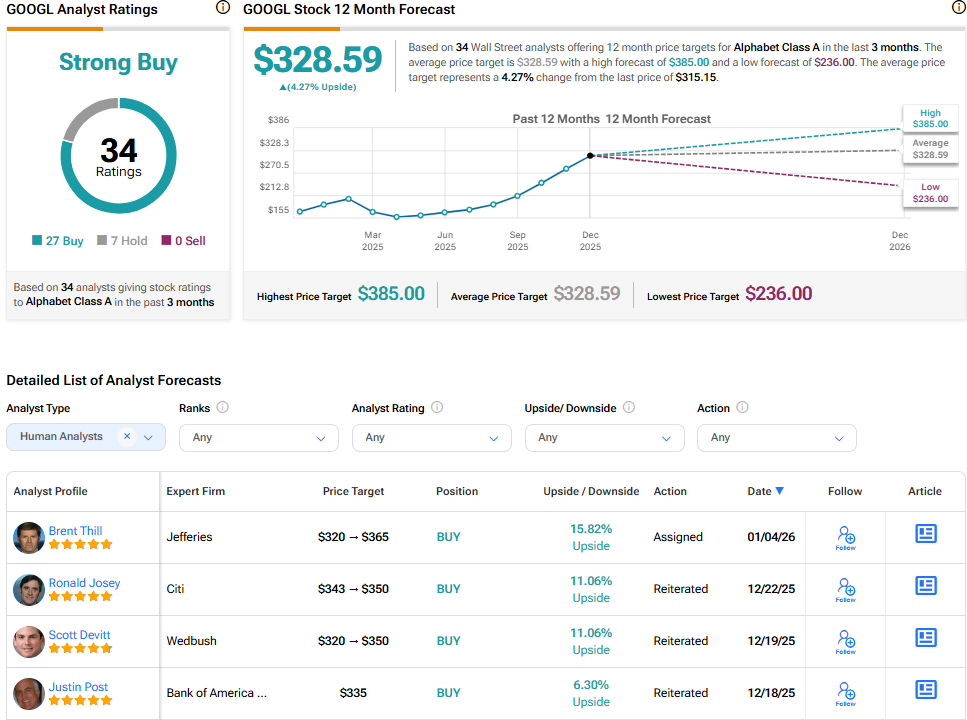

Is Google Stock a Buy?

Google still holds the backing of the Street’s analysts, with a Strong Buy consensus rating. The average GOOGL stock price target stands at $328.59, implying an 4.27% upside from the current price.