As businesses continue with digital transformation, the battle for cloud dominance is heating up. Amazon’s (AMZN) AWS and Alphabet’s (GOOGL) Google Cloud are among the biggest players in the game. While AWS remains the market leader with its mature ecosystem, Google is making aggressive strides with AI-driven innovation and strategic partnerships. Let’s compare how the two cloud titans stack up in the last quarter of 2024.

AWS vs. Google Cloud: Revenue Breakdown

According to Main Street Data, AWS generated $28.8 billion in revenue in Q4 2024, making up 18.1% of Amazon’s total revenue and reflecting a 19% year-over-year increase.

In comparison, Google Cloud brought in $12 billion during the same quarter, accounting for 14% of Google’s total revenue but showing a stronger year-over-year growth of 30%.

AWS Leads in Profitability, but Google Cloud Is Closing In Fast

On the profitability front, AWS reported $10.6 billion in operating income for Q4 2024, up 48.3% year-over-year. In comparison, Google Cloud posted $2.09 billion, but with a stronger 142% growth over the same period.

AWS continued to show strong profitability, with its operating margin rising to 36.9% in Q4 2024 from 29.6% a year earlier. In contrast, Google Cloud’s operating margin stood at 17.5% in the fourth quarter.

While lower in absolute terms, Google Cloud’s margin grew at a faster pace, up 86% year-over-year compared to AWS’s 24.6% growth. This highlights Google’s rapid progress in narrowing the profitability gap, even as AWS remains the clear leader in margin strength.

GOOGL or AMZN: Which Stock Offers More Upside?

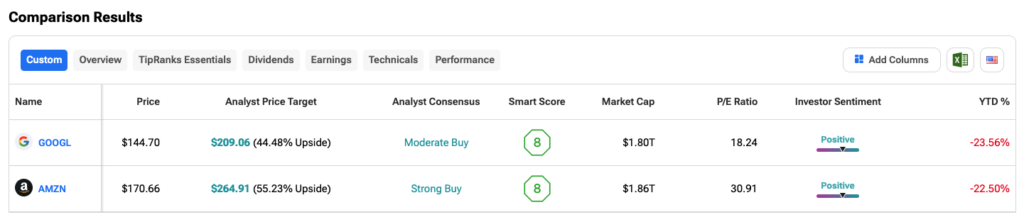

According to TipRanks Stock Comparison tool, AMZN stock carries a Strong Buy rating from analysts, while GOOGL stock is rated Moderate Buy. In terms of share price growth, Amazon’s stock forecast of $264.91 offers an upside potential of 55.23%. That said, GOOGL’s share price target of $209.06 implies a growth rate of 45% from current levels.