Crypto ads on Google (GOOGL) are about to get a lot harder to run in Europe. Starting April 23, the tech giant will only allow cryptocurrency exchanges and wallet apps to advertise if they hold a license under the European Union’s Markets in Crypto-Assets (MiCA) framework. If your firm isn’t fully registered under MiCA or doesn’t pass Google’s own certification process, your ads won’t fly.

Google Tightens the Screws on Crypto Ads

This isn’t just some light policy tweak. Google made it clear that exchanges and wallet providers will need both a MiCA license and its own ad certification to keep advertising on its platforms across 27 European countries. That means any crypto firm hoping to advertise must comply with MiCA—or hit pause.

The company will give violators a grace period. Instead of an immediate ban, Google said it will issue warnings at least seven days before any suspensions. For some, that might buy enough time to scramble toward compliance. But the bar has officially been raised.

National Loopholes Won’t Last Forever

There is a temporary reprieve for platforms already advertising under local regimes in France, Germany, and Finland. Their national licenses will still hold water until each country’s MiCA transition period ends sometime between mid and late 2025. But make no mistake—MiCA is the endgame. The days of piecing together compliance across multiple jurisdictions are numbered.

Several big names are already in the clear. According to CoinDesk, OKX, Crypto.com, Bitpanda, Boerse Stuttgart Digital, eToro, and MoonPay have secured their MiCA credentials. But smaller players could face an uphill battle.

Google Stock (GOOGL) Holds Steady as Crypto Exposure Grows

Meanwhile, Google’s parent company Alphabet (GOOGL) is quietly becoming more crypto-savvy. The stock is up over 12% year-to-date, riding strong AI tailwinds and robust ad revenues. But there’s more under the hood.

Google Cloud’s partnership with Coinbase (COIN) opened the door for Web3 services. It also joined the ranks of top investors in blockchain startups like Fireblocks and Dapper Labs. So while this new policy tightens the gate for advertisers, Google’s actual exposure to crypto is growing behind the scenes.

Some analysts say the move may help Alphabet dodge future regulatory heat. Others note it could limit short-term ad revenue from smaller exchanges. But overall, Wall Street seems unfazed. The stock’s long-term bullish outlook remains intact, especially with earnings around the corner.

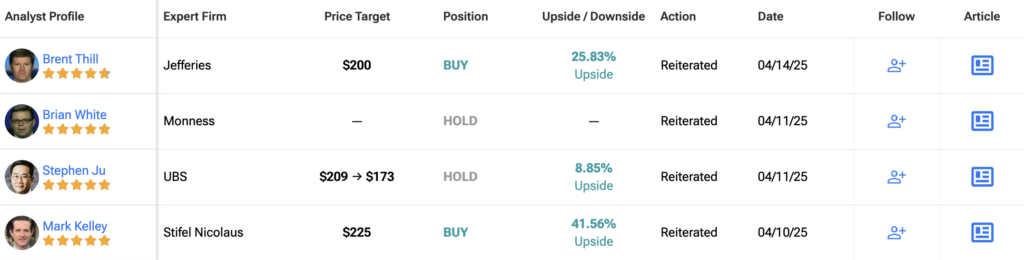

Is Google Stock a Buy, Sell, or Hold?

Overall, Wall Street analysts have a bullish outlook on GOOGL stock. Out of the 37 analysts covering the stock in the past three months, 27 recommend a Buy, while 10 suggest a Hold. Not a single analyst recommends Selling GOOGL stock. The average price target for GOOGL stock is $204.09 per share, which implies an upside potential of 29% from the current price.