Motive, a company backed by tech giant Google (GOOGL), filed paperwork on Tuesday to go public on the New York Stock Exchange under the ticker “MTVE.” Interestingly, the firm makes software and hardware used by businesses to manage truck fleets and drivers. Furthermore, Motive joins a growing group of technology companies that are considering going public in 2026, such as OpenAI (PC:OPAIQ), Anthropic (PC:ANTPQ), and SpaceX (PC:SPXEX).

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Financially, Motive is still in growth mode and remains unprofitable. In the third quarter, the company reported a net loss of $62.7 million on revenue of $115.8 million, with losses widening from $41.3 million a year earlier. At the same time, revenue rose by about 23% year-over-year, and Motive ended September with nearly 100,000 customers. Importantly, most of Motive’s revenue comes from subscription services, although it also sells replacement hardware and professional services.

Interestingly, it is also worth noting that Motive’s AI-powered dashcam technology has helped prevent 170,000 collisions and save 1,500 lives by detecting unsafe driving behavior. Moreover, the company rebranded as Motive in 2022 and employed 4,508 people as of Sept. 30, including 400 full-time data annotators who help train its AI models. However, one risk that investors should keep in mind is Motive’s ongoing patent dispute with competitor Samsara (IOT), which is a public company with a market value of roughly $22 billion.

Is GOOGL Stock a Good Buy?

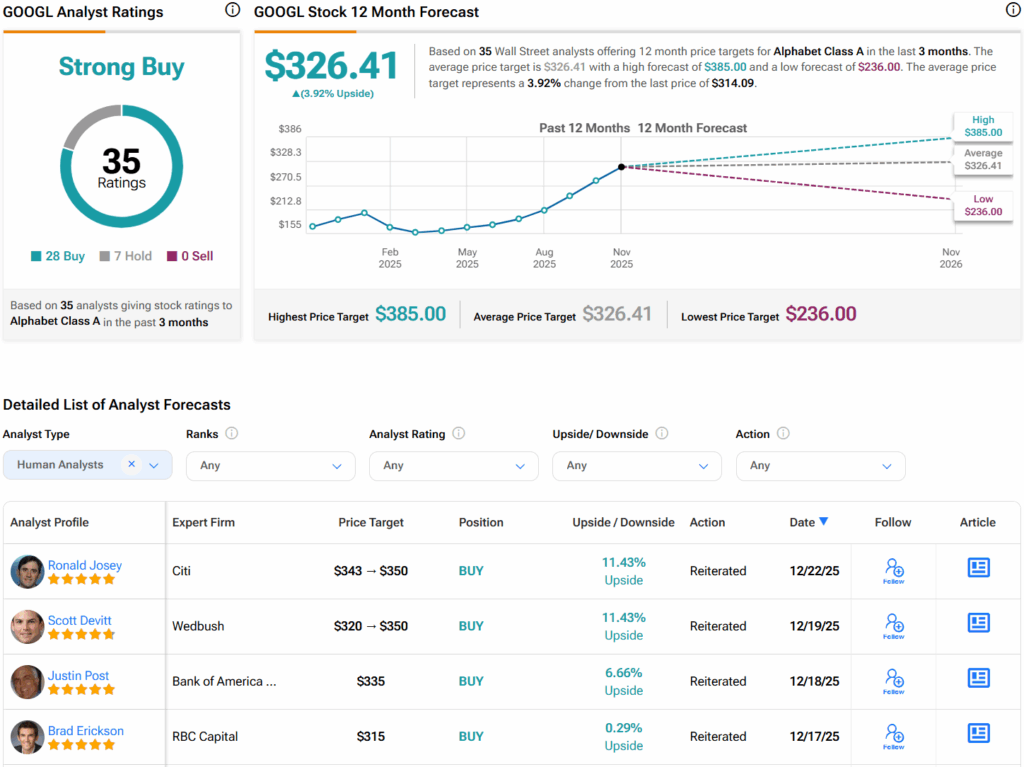

Turning to Wall Street, analysts have a Strong Buy consensus rating on GOOGL stock based on 28 Buys and seven Holds assigned in the past three months. Furthermore, the average GOOGL price target of $326.41 per share implies 4% upside potential.