Alphabet’s (GOOGL) Google and Palantir Technologies (PLTR) have joined hands to integrate Google Cloud into PLTR’s FedStart program. With this move, the companies aim to deliver advanced AI solutions to U.S. government agencies. Following the news, PLTR stock rose 7.3%, while GOOGL stock increased 2.6% in yesterday’s trading session.

FedStart is an initiative that helps streamline software deployment for government entities. It enables tech companies and startups to offer their software solutions to the government more efficiently.

GOOGL-PLTR Deal to Build a Secure Federal Platform

By teaming up with Google Cloud, PLTR aims to combine Google’s strong cloud systems with its compliance-driven tools to build a safe and scalable setup for federal operations.

This integration aims to foster innovation in the U.S. public sector. It ensures the delivery of compliant solutions across multiple cloud environments while following strict security rules.

One of the key highlights of this deal is the integration of Anthropic’s Claude AI application into the FedStart platform. Hosted on Google Cloud, Claude offers enterprise-grade AI capabilities, designed to handle large-scale government tasks such as complex data analysis and strategic problem-solving.

Overall, this partnership will help bring advanced technologies to federal agencies, boosting efficiency and strengthening security.

Alphabet to Report Q1 Earnings Today

The partnership comes just ahead of the company’s Q1 earnings report, due today.

Overall, Wall Street analysts expect GOOGL to report Q1 2025 earnings per share (EPS) of $2, reflecting a 5.8% year-over-year rise. Meanwhile, Alphabet’s revenue is expected to increase 10.8% to $89.18 billion in the first quarter.

What Is the Price Target for GOOGL?

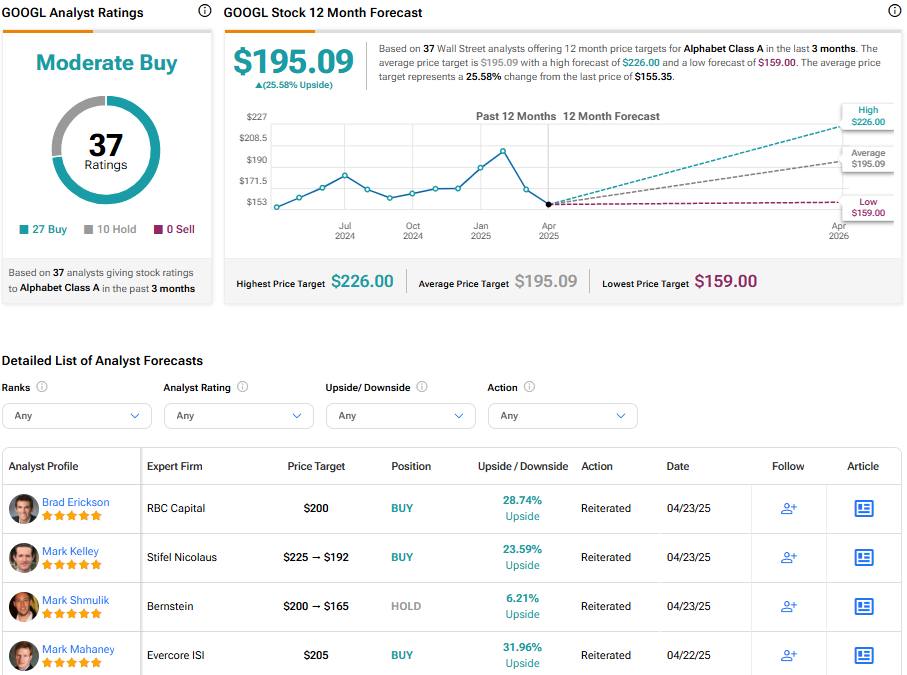

Turning to Wall Street, GOOGL stock has a Moderate Buy consensus rating based on 27 Buys and 10 Holds assigned in the last three months. At $195.09, the average Alphabet price target implies a 25.58% upside potential.