Shares of Alphabet (GOOGL) gained in after-hours trading after the tech titan reported its Q2 results. Earnings per share came in at $1.89, which beat analysts’ consensus estimate of $1.84 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Revenue climbed 13.6% to $84.74 billion, beating expectations by $450 million as ad revenue jumped to $64.616 billion from the previous $58.143 billion. Furthermore, Google Cloud grew from $8,031 billion to $10.347 billion year-over-year, which beat analysts’ expectations of $10.2 billion. Interestingly, though, YouTube advertising revenue missed estimates after coming in at $8.66 billion. For reference, Wall Street was anticipating $8.93 billion.

Nevertheless, GOOGL returned over $18.15 billion to shareholders during the second quarter. Dividends made up $2.466 billion, or $0.20 per share, while buybacks made up the remaining $15.684. The firm has regularly repurchased its shares in each of the most recent quarters (as demonstrated in the image below).

Are Google Shares a Good Buy?

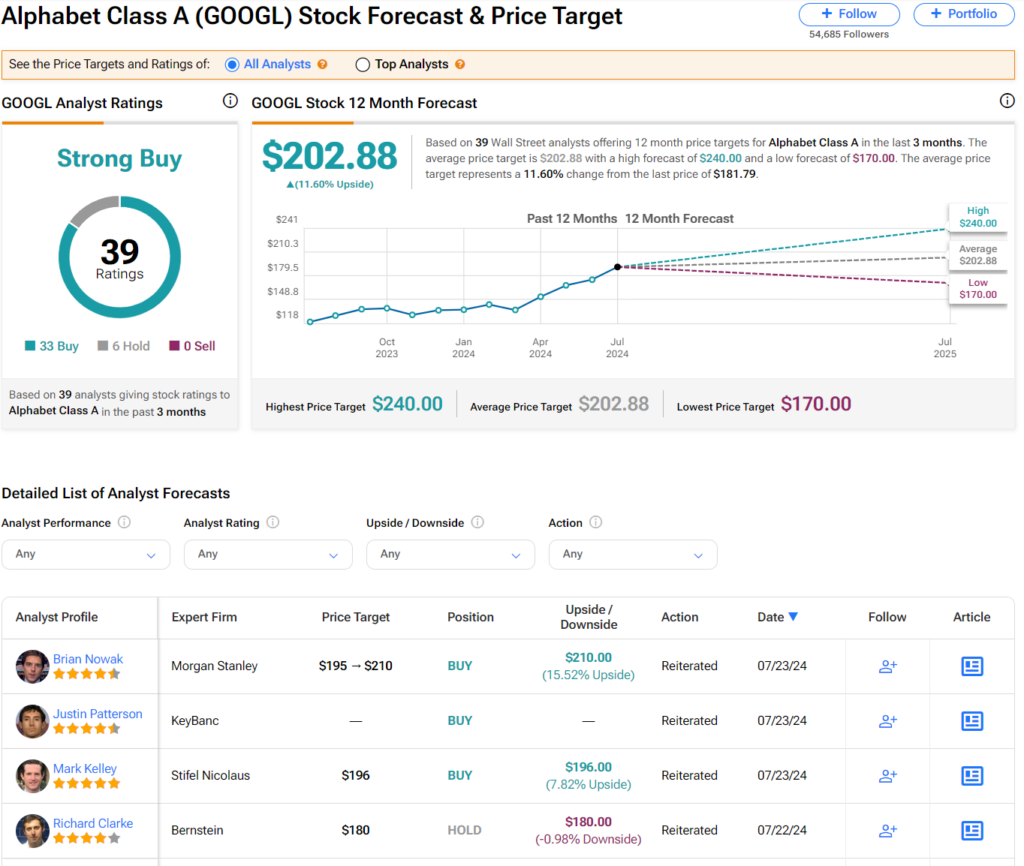

Turning to Wall Street, analysts have a Strong Buy consensus rating on GOOGL stock based on 33 Buys, six Holds, and zero Sells assigned in the past three months. After a 50% rally in its share price over the past year, the average GOOGL price target of $202.88 per share implies 11.68% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.