Meal-kit subscription company Goodfood Market Corp. (TSE:FOOD) reported a promising quarter. Yes, revenue missed expectations (C$42 million vs. estimates of C$43.8 million), and revenue fell 43% year-over-year because the company phased out its on-demand delivery business. However, FOOD reported a net profit of C$0.1 million compared to last year’s figure, which was C$21 million lower.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

This marks a big turnaround for the company. Last year, Goodfood laid out plans to return to adjusted EBITDA profitability by 2023 via cost-cutting and scaling down its operations. Now, the company is profitable again, at least on an adjusted EBITDA and net income basis.

For the quarter ended March 4, 2023, Goodfood’s adjusted EBITDA was C$3 million, a large improvement from the -C$14 million recorded in the same period last year. Also, the company reiterated its forecast of being adjusted EBITDA profitable in the next quarter as its cost-cutting measures are now complete. Notably, Goodfood’s gross profit margin came in at a quarterly record 40.7% compared to last year’s 24% gross margin.

Meanwhile, adjusted free cash flow was negative, at -C$2.2 million but was much better than last year’s -C$22.3 million.

Is Goodfood Stock a Buy, According to Analysts?

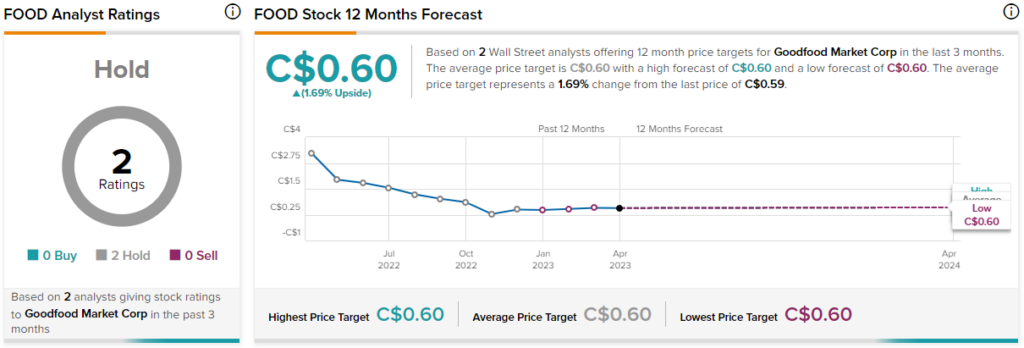

Analysts currently have a Hold consensus rating on FOOD stock based on two Holds assigned in the past three months. The average Goodfood stock price target of C$0.60 implies 1.7% upside potential.