Tesla (NASDAQ:TSLA) stock could get a major lift if it pulls off a successful rollout of its FSD (full self-driving) software in China. With the country’s massive auto market, intensifying race in autonomous tech, and the profit potential of AI-driven products, FSD could become a cornerstone of Tesla’s future valuation.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

That, in any case, is the view of Goldman Sachs’ 5-star analyst, Mark Delaney, who emphasizes that China hasn’t just become a focal point for Tesla’s autonomous ambitions – it’s also grown into the company’s largest market for new vehicle sales over the past year.

This shift isn’t surprising given both the size of the Chinese market and the country’s relatively high adoption of battery electric vehicles (BEVs). But Delaney also attributes it to evolving market dynamics. Tesla’s share of the U.S. BEV market has slipped to around 45% as of Q1, and its presence in Europe has fallen to the low double digits. In contrast, its market share in China has remained relatively stable, holding in the high single digits.

That backdrop makes Tesla’s recent FSD progress in China all the more significant. In late February, media reports revealed that the company had rolled out FSD upgrades to some local users who had purchased its ¥64,000 ($8,750 USD) software package, adding capabilities like lane changes, traffic light recognition, and turning. During the Q1 earnings call, Tesla confirmed it launched a supervised version of FSD in China using its existing generalized software with minimal localized data.

While the system has historically performed better in the U.S. due to richer datasets, early reviews from China suggest promising performance, though some glitches, particularly around lane usage and traffic rules, remain. According to Delaney, these issues likely stem from the “more limited” data available for the Chinese market.

Tesla’s FSD, however, is just one of several ADAS options available to consumers in China, where many local competitors include similar features as standard on mainstream vehicles.

“The level of technology and cost improvement that Tesla can achieve with FSD, both absolute and relative to competitors, will be key for its longer-term economics related to autonomy in our opinion (both globally and in China),” Delaney opined.

Tesla aims to launch robotaxi services in Texas in June, with plans to expand over time. In the U.S., Tesla’s vehicle costs could give it an edge over other robotaxi options, provided its technology reaches the required level for deployment. In Q1, Tesla’s cost of goods sold (COGS) per vehicle was about $35.5K, and its newer HW4-equipped vehicles have the hardware necessary for Level 4 autonomy. If Tesla expands robotaxi operations to China, it will face a different competitive environment, with several autonomous vehicles offering attractive costs.

“We believe technology development, scale/cost, and regulatory approvals will be key factors to monitor to assess Tesla’s success with robotaxis in the region,” the analyst went on to add.

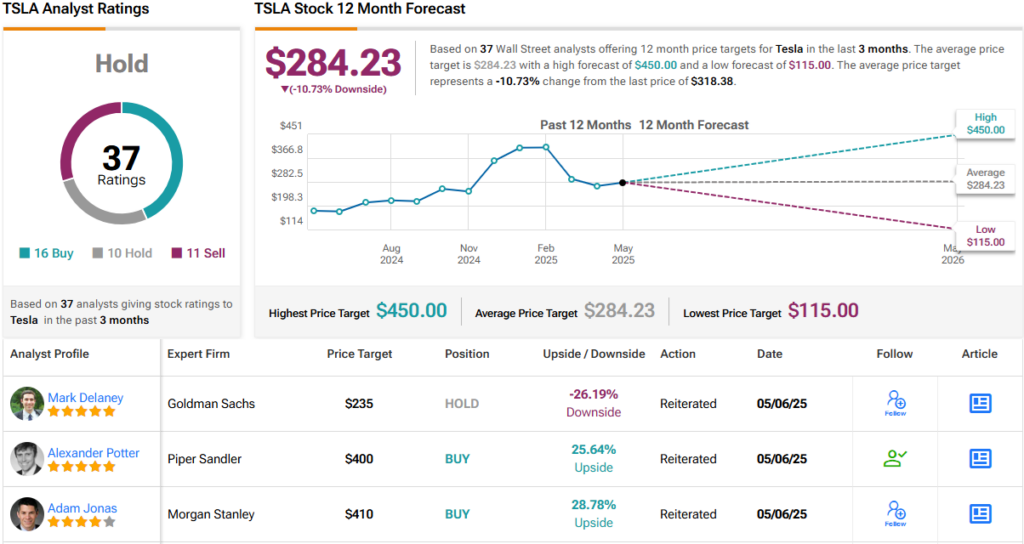

Down to business, what does this all mean for investors? Despite the excitement around FSD and robotaxis, Delaney, who’s ranked in the top 3% of stock pros on TipRanks, isn’t ready to jump on the bullish bandwagon just yet. The analyst rates Tesla shares a Neutral, while his $235 price target implies the stock is overvalued by 26%. (To watch Delaney’s track record, click here)

9 other analysts are also on the fence here and with an additional 16 Buys and 11 Sells, the analyst consensus rates Tesla stock a Hold. Going by the $284.23 average price target, shares will drop ~11% from current levels. (See TSLA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.