Apple (NASDAQ:AAPL) certainly knows how to build anticipation – and it’s doing so again with the announcement of its upcoming special event, ‘Awe-Dropping,’ on September 9. Though details are scarce, expectations are mounting that the tech giant will unveil its iPhone 17 series alongside a new Apple Watch.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For Apple investors, the event carries added weight. Despite a gradual climb in recent months, Apple’s stock is still down 4% year-to-date vs. the NASDAQ’s 12% climb. Concerns that the company has missed out on the AI boom, coupled with broader economic jitters, have cast a shadow over sentiment.

That raises the question of whether this ‘awe-dropping’ showcase could be the catalyst AAPL needs to regain momentum.

Goldman Sachs analyst Michael Ng believes it just might. While past Apple events have often done little to move the stock, Ng sees this launch as different – with the iPhone 17 lineup positioned to play a pivotal role in reigniting revenue growth.

“Overall, we view the iPhone 17 line-up as supportive of sustaining iPhone revenue growth from F2025 into F2026,” explains the 5-star analyst. He points to several drivers, from upgrades in the new model to expected price hikes for the iPhone 17 Pro, as well as competitive carrier promotions that should stimulate demand.

Another key factor is compute power. The iPhone 17’s enhanced capabilities are designed to integrate seamlessly with Apple’s upcoming AI-enhanced Siri, which is slated for release next year. Given that more than half of Apple’s Fiscal 2024 revenue came from iPhones, Ng stresses that a successful device refresh cycle is critical. The improved cameras and chip performance in the base model, he notes, could encourage upgrades, particularly from users whose older phones won’t support Apple Intelligence.

“We reiterate our Buy rating on AAPL and forecast iPhone revenue to grow +5% yoy in F2025E before accelerating to +7% yoy growth in F2026E,” summarizes Ng, who also gives the stock a $266 price target, which implies ~11% upside from current levels. (To watch Michael Ng’s track record, click here)

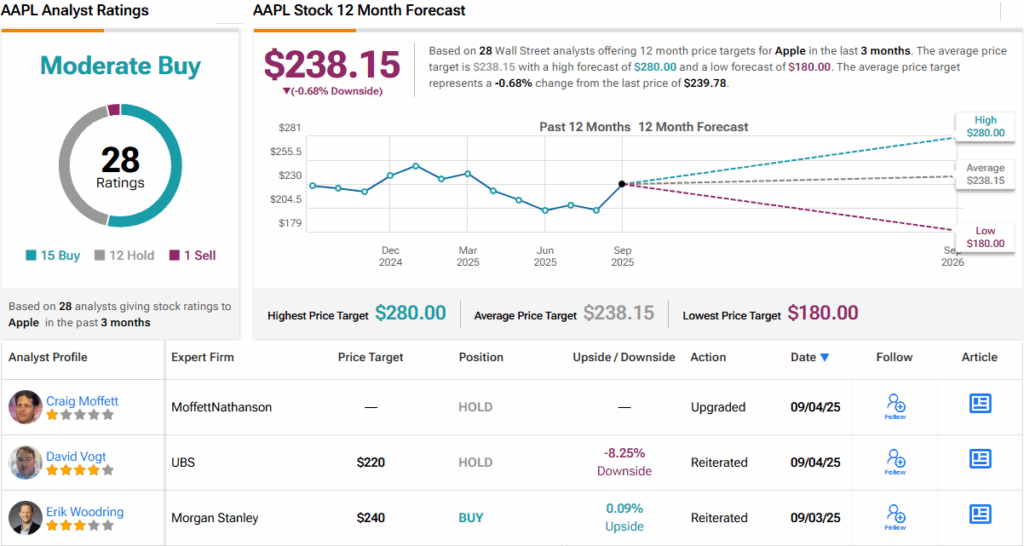

Overall, Wall Street is moderately bullish. Out of 27 analyst reviews, 15 call AAPL stock a Buy, 11 suggest a Hold, and only one advises a Sell. The average price target sits at $238.45, suggesting shares will stay range-bound for the foreseeable future. (See AAPL stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.