Discount retailer Walmart (WMT) stock forecast received a boost from Goldman Sachs’ price target hike. Analyst Kate McShane of Goldman Sachs lifted the price target on WMT stock to $106 from $101 yesterday, while maintaining her “Buy” rating. The revised price target implies a 24.4% upside potential from current levels.

It is worth noting that McShane ranks 1,187 out of more than 9,444 analysts tracked by TipRanks. She has a success rate of 61%, with an average return per rating of 4.50% over a one-year timeframe.

McShane’s Views on WMT Stock

Ahead of Walmart’s Investment Community Meeting on April 8-9, a Top analyst remains positive about the company’s fundamentals. At this event, Walmart executives will share updates on business performance, key strategies, and future plans. The analyst sees the meeting as a potential catalyst for the stock, highlighting the benefits of Walmart’s automation efforts.

It’s important to note that Walmart has been doubling down on automation to boost efficiency and improve customer service. The company recently joined forces with Symbotic, a warehouse automation firm, to roll out robots that handle storage, retrieval, and packing. By 2026, Walmart plans to have 65% of its stores automated, helping cut costs and speed up processes.

This focus on automation is a key part of Walmart’s long-term strategy, and the upcoming meeting could provide more clarity on how these efforts will impact the company’s future. With executives set to discuss key initiatives, investors will be watching closely for insights on how automation is impacting Walmart’s operations, costs, and overall growth.

Beyond automation, Walmart’s strong financial position remains a key strength. McShane noted that the company is well-positioned for earnings growth in 2025, backed by its solid market presence and appeal to budget-conscious shoppers. Walmart’s latest fiscal Q4 results reinforced this confidence, with revenue up 4.1% to $180.6 billion, meeting Wall Street’s expectations. Meanwhile, adjusted EPS rose 10% year-over-year to $0.66, in line with forecasts.

Is Walmart Stock a Good Buy Right Now?

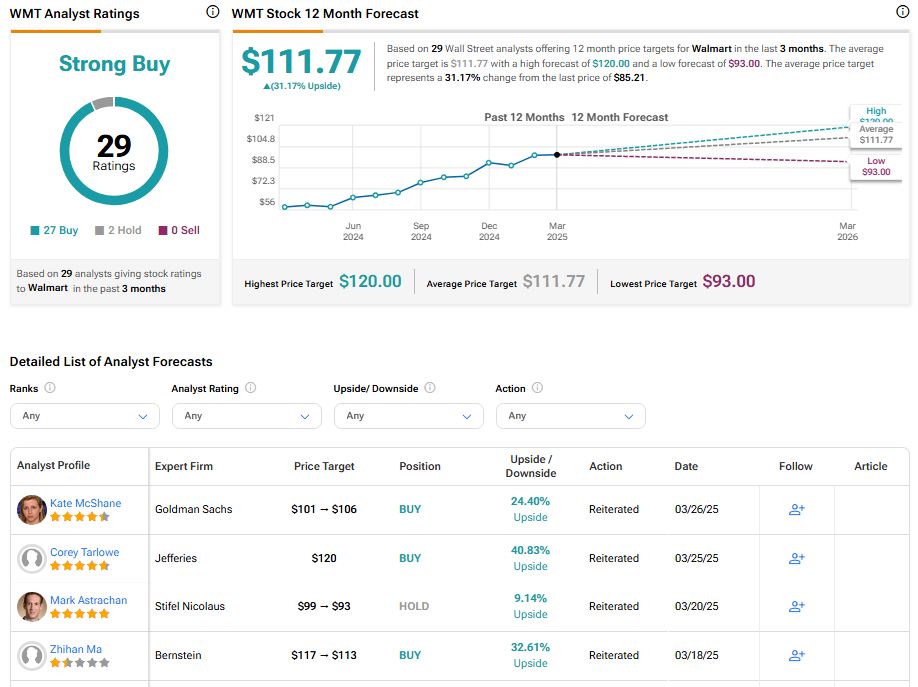

Turning to Wall Street, analysts have a Strong Buy consensus rating on WMT stock based on 27 Buys and two Holds assigned in the past three months, as indicated by the graphic below. After a 41.9% rally in its share price over the past year, the average WMT price target of $111.77 per share implies 31.17% upside potential.