Goldman Sachs (GS) has enjoyed a remarkable 66% rally over the past year, driven by robust earnings reports. The investment banking giant released its Q4 results last Wednesday, crushing estimates and beating analyst estimates on revenue and profit. The company made the most of a strong deal-making environment and saw solid growth in its asset management business. Looking ahead to FY2025, things are shaping up nicely for Goldman, with investment banking and capital markets looking strong. Moreover, Goldman seems to be trading at a pretty appealing valuation, so I’m sticking with a positive outlook on GS stock.

Results Showcase Thriving Investment Banking Environment

Goldman Sachs closed 2024 with an extraordinary fourth quarter, delivering results that beat expectations and showcased the underlying, thriving investment banking environment. Goldman posted net revenue of $13.87 billion for the quarter, marking a 23% year-over-year increase and beating Wall Street’s estimates by a wide margin of $1.41 billion. In the meantime, net earnings surged to $4.11 billion, with earnings per share of $11.95 beating estimates by $3.60 and rising by 118%. Meanwhile, elsewhere in the sector, most of Goldman’s industry peers delivered solid fourth-quarter results, but Goldman absolutely blew past analysts’ expectations.

More specifically, the company’s Investment Banking division shone due to a significant uptick in M&A advisory and underwriting activity. Debt underwriting revenues climbed sharply, supported by robust leveraged finance activity as credit conditions stabilized. Meanwhile, equity underwriting benefited from a revival in IPO markets and secondary offerings. Interestingly, CEO David Solomon stressed that Goldman’s top-tier advisory franchise maintained its leadership as the #1 ranked M&A advisor globally, which bodes well for future deal flow.

In addition, the markets division delivered exceptional results. Fixed Income, Currencies, and Commodities (FICC) revenues grew 35% year-over-year, with substantial contributions from currencies and mortgages. Equities financing hit a record $1.5 billion, driven by vigorous financing activity and increased client engagement. The asset and wealth management division also delivered, with fees hitting $2.8 billion — an all-time high — thanks to higher assets under management and steady growth in incentive fees. Clearly, the company’s strategy to boost fee-based revenue streams through scaled client solutions continues to bear fruit.

Goldman Eyes More of the Same in 2025

Looking ahead to 2025, Goldman Sachs is well-positioned to leverage multiple industry trends and internal initiatives to fuel further growth. I think there’s tremendous value in picking up on hints from executives and hearing CEO David Solomon highlight a notable rise in large-cap M&A dealmaking, increased sponsor activity, and a growing appetite for IPOs signals that the strong deal-making environment will likely persist. The growth in the firm’s investment banking backlog during Q4 reinforces management’s confidence in seeing a steady rise in advisory and underwriting revenues.

In wealth management, Goldman’s aspirations to deepen its penetration into ultra-high-net-worth lending, improve digital capabilities, and scale alternative investments are also expected to contribute to revenue and earnings growth. An improving regulatory and macroeconomic environment, supported by a pro-corporate incoming U.S. President and further rate cuts on the horizon, creates a favorable backdrop for Goldman to further capitalize on its strong momentum.

Is GS a Good Long-Term Investment?

Despite its lengthy rally over the past year, I believe Goldman Sachs stock remains attractively priced relative to its growth prospects. The stock trades at just 13.5x the consensus FY2025 earnings, with Wall Street analysts forecasting an EPS growth of 15% for 2025. This is followed by an expected 10% EPS growth in 2026, driven by favorable market conditions, which positions Goldman Sachs’ forward-looking multiple to decline further next year.

This suggests sustained share price gains (assuming the stock maintains a P/E in the low teens, in line with its historical average). In fact, I believe last year’s share repurchases, which amounted to $7.14 billion (up from $5.09 billion in 2023), should prove exceptionally accretive in FY2025’s EPS, possibly resulting in another bottom-line beat.

Is Goldman Sachs a Buy, Sell, or Hold?

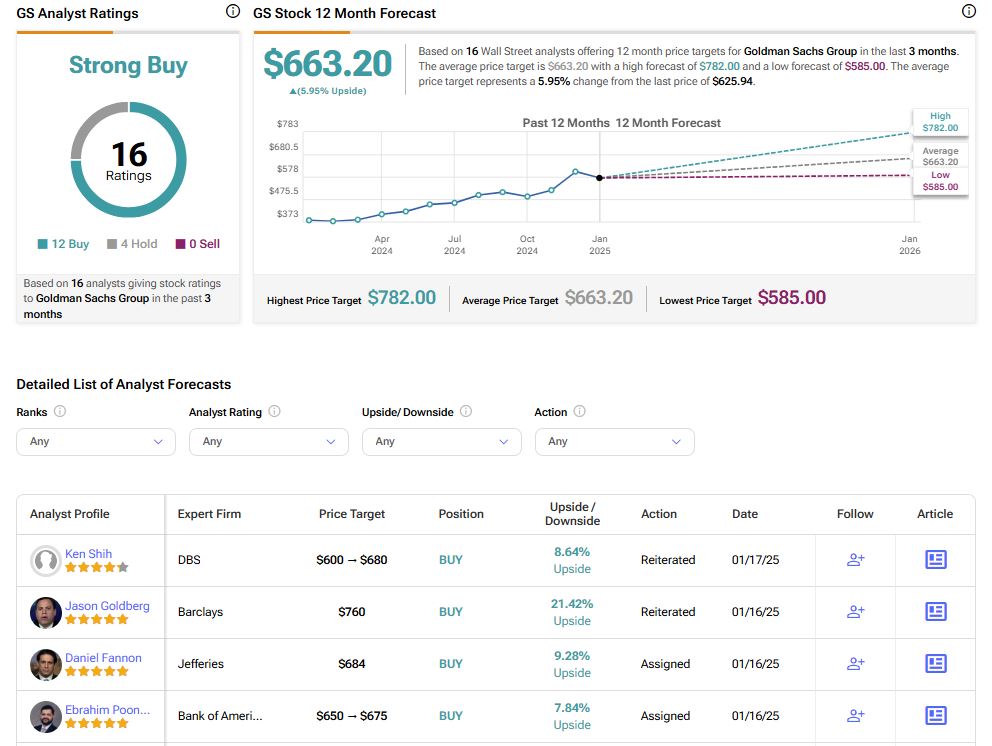

Wall Street remains bullishly optimistic on Goldman Sachs. While most analysts have yet to issue post-earnings targets, the stock carries a Strong Buy rating among 16 analysts. In particular, GS has received 12 Buy and four Hold ratings over the past three months, with no analyst rating the investment banking giant as a Sell. GS stock carries a stock price target of $663.20, which implies almost 6% upside potential from current levels.

If you’re unsure which analyst to trust if trading or investing in GS stock, Chris Kotowski from Oppenheimer (OPY) stands out as the most accurate and profitable over the past 12 months. He rates Goldman as a Buy. His recommendations have delivered an average return of 25.3% per rating, with a 73% success rate.

Goldman Establishes Upward Trajectory

Since the Global Financial Crisis (GFC) in 2007-09, Goldman Sachs has gone from strength to strength, posting impressive results for over a decade. More recently, its impressive run includes robust Q4 2024 results highlighting its leading position in investment banking. A booming deal-making environment fueled record-breaking revenues across the board, while smart moves in asset and wealth management have positioned the firm for a bright 2025. Given its attractive valuation and steady EPS growth, it’s easy to see why I’m adding this stock to my portfolio despite its extended in recent months.

Questions or Comments about the article? Write to editor@tipranks.com