U.S. investment bank Goldman Sachs (GS) says that equity markets could get a major boost this year from $1 trillion in stock buybacks, the most in at least five years.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Goldman Sachs analyst Scott Rubner says that a corporate share repurchase window is scheduled to start on January 24, and that nearly half (45%) of all companies in the benchmark S&P 500 index are expected to participate, a development that could provide a tailwind to U.S. markets.

Rubner is forecasting that companies listed in the U.S. could spend $1.07 trillion buying back their own stock this year. Such a big share repurchase would help to push stock prices higher in the near-term and alleviate some of the volatility in equity markets.

“Straight Up Cash”

In a note to clients about the impending stock buybacks, Rubner wrote: “This is straight up cash, homie,” and added that “money is moving and ready to buy equities once the headlines (and prices) start to settle down.”

Despite his bullish outlook, Rubner also noted that investors have poured about $143 billion into money market funds since the start of the year, the largest allocation since March 2020 when the Covid-19 pandemic hit. Such a large flow into cash is usually a sign of expected market turbulence. However, Rubner urges investors to “keep their powder dry” and be ready to jump into equities when they rise.

GS stock has risen 67% over the last 12 months.

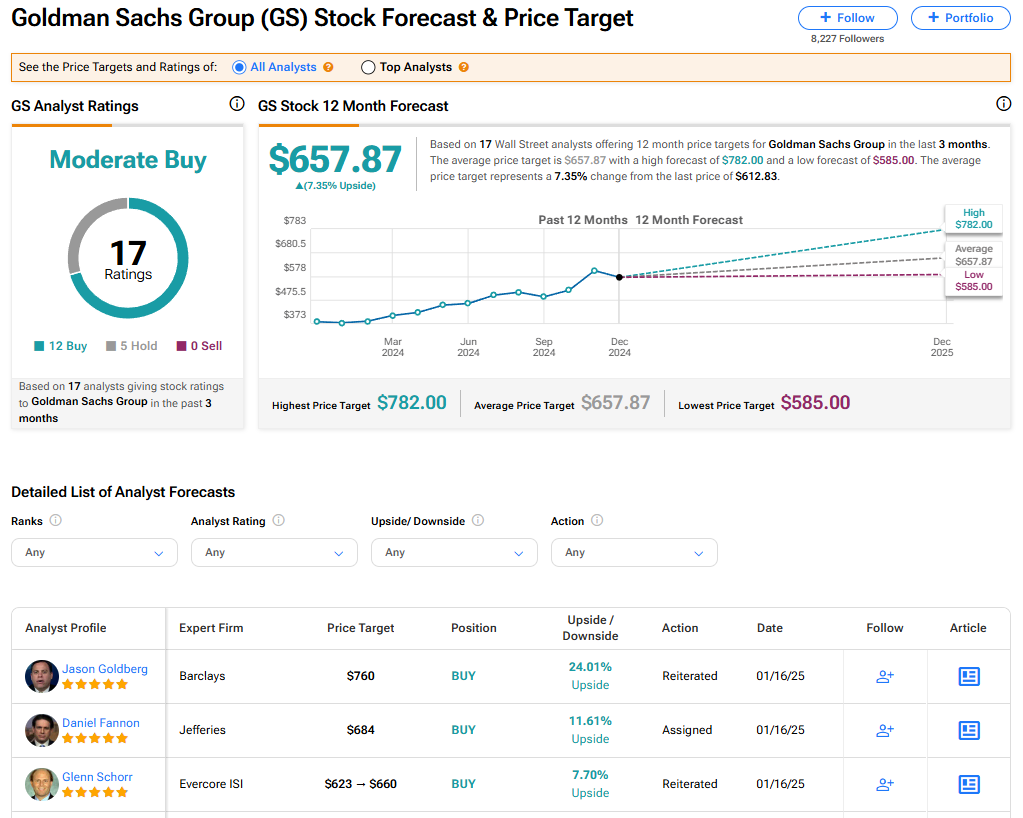

Is GS Stock a Buy?

The stock of Goldman Sachs has a consensus Moderate Buy rating among 17 Wall Street analysts. That rating is based on 12 Buy and five Hold recommendations made in the last three months. The average GS price target of $657.87 implies 7% upside from current levels.