Wall Street investment bank Goldman Sachs (GS) has turned more bullish on stocks.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In a note to clients, Goldman Sachs raised its year-end target for the benchmark S&P 500 index to 6,800 from 6,600 previously. Analysts at the bank expect stocks to benefit from a dovish U.S. Federal Reserve and continued strength in corporate earnings. The new year-end target is about 2% higher than where the S&P 500 is currently at.

Beyond its year-end forecast, Goldman Sachs also lifted its six- and 12-month return forecasts for the S&P 500 to 5% and 8% respectively. Those forecasts would see the benchmark U.S. index at 7,000 within six months and 7,200 by this time next year.

Bear to Bull

The latest forecast is a reversal for Goldman Sachs, which had spent most of this year worried about a potential recession in the U.S. Earlier this year, Goldman Sachs had forecast the S&P 500 would end the year below 6,000 after U.S. President Trump’s tariffs upended global financial markets.

Goldman Sachs says it has gone from bear to bull now that the U.S. central bank has lowered interest rates for the first time since last December and signaled that two more rate cuts are likely by year’s end. The Federal Reserve’s pivot on interest rates, and signs of easing tariff pressure, have reduced the risks of a recession, says Goldman.

At the same time, the investment bank expects corporate earnings to remain resilient for the rest of this year and heading into 2026. Wall Street expects third-quarter financial results to be strong, with consensus forecasts calling for mid-single-digit expansion heading into the final quarter of the year.

Is GS Stock a Buy?

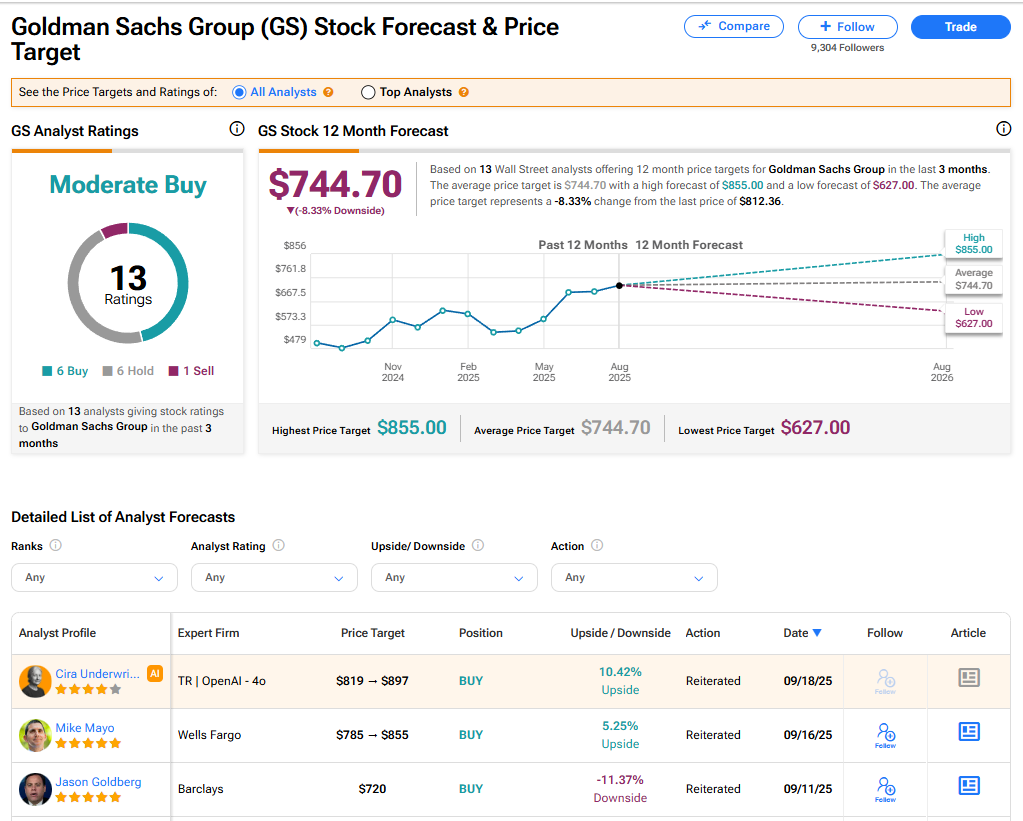

The stock of Goldman Sachs has a consensus Moderate Buy rating among 13 Wall Street analysts. That rating is based on six Buy, six Hold, and one Sell recommendations issued in the last three months. The average GS price target of $744.70 implies 8.33% downside from current levels.