Wall Street investment bank Goldman Sachs (GS) is forecasting “lower but attractive returns” for equity markets in 2026.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

In its Global Opportunity Asset Locator report, Goldman Sachs says that stocks this year should continue to be supported by resilient growth, easing inflation, and continued policy support. Specifically, the firm said it “remains modestly pro-risk into 2026 given a friendly baseline of sturdy global growth, further declines in inflation, and continued policy support.”

However, Goldman Sachs does warn that some of the strongest market tailwinds of recent years are beginning to fade, notably related to interest rates and monetary policy. Additionally, Goldman says that “AI tailwinds are likely to shift from capex to adoption” this year.

Elevated Stock Valuations and Other Risks

Goldman Sachs also points to elevated valuations, which it describes as “typical late cycle” for a stock market rally that is now in its third year. Still, Goldman Sachs believes stocks should benefit from improving economic momentum in the months ahead.

The firm wrote that “equities tend to perform well with better growth, policy easing and falling inflation,” adding that being underinvested in late cycle bull markets “can be costly” for investors. Looking out over the entire year, Goldman Sachs expects corporate earnings growth to drive most of the upside in 2026, noting that corporate balance sheets remain “strong.”

Regionally, Goldman Sachs said that it is overweight Asia ex-Japan, neutral on the U.S. and Japan, and underweight European equities.

Is GS Stock a Buy?

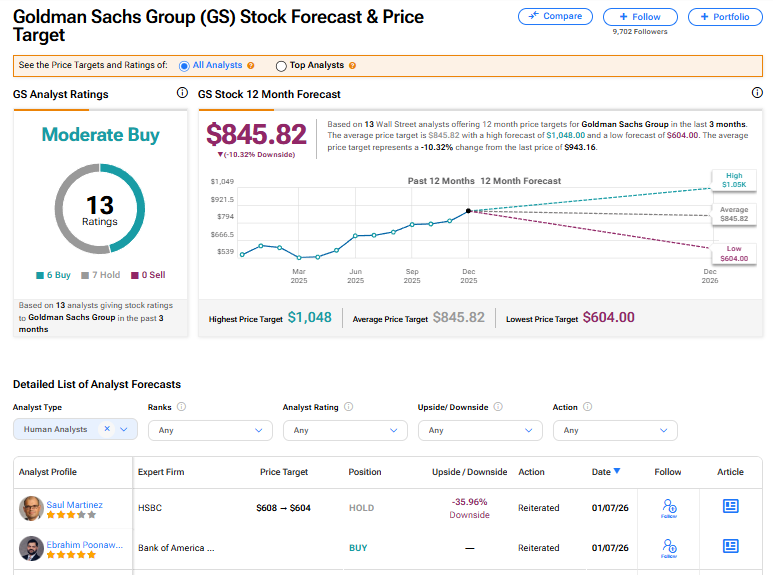

Goldman Sachs’ stock has a consensus Moderate Buy rating among 13 Wall Street analysts. That rating is based on six Buy and seven Hold recommendations issued in the last three months. The average GS price target of $845.82 implies 10.32% downside from current levels.