Goldman Sachs (GS) and BNY (BK) are launching a new service that gives institutional clients access to tokenized money market funds. These funds will be recorded directly on Goldman’s private blockchain, giving investors 24/7 access, faster settlement times, and clearer ownership tracking.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The two financial giants are working with asset managers including BlackRock (BLK), Fidelity, and Federated Hermes (FHI), along with their own asset management arms. According to the release, clients of BNY, the world’s largest custodian bank, will be able to invest in these funds as the industry shifts toward more digital systems.

“As the financial system transitions toward a more digital, real-time architecture, BNY is committed to enabling scalable and secure solutions that shape the future of finance,” said Laide Majiyagbe, Global Head of Liquidity, Financing and Collateral at BNY.

Why Tokenized Money Market Funds Are Gaining Momentum

The launch comes shortly after the GENIUS Act was signed into law in the U.S. The law bans interest-bearing stablecoins, which has left a gap for investors looking for yield-bearing assets in token form. Tokenized money market funds now look like a logical solution.

These funds function like regular money market funds that hold short-term assets such as U.S. Treasurys, but they use blockchain to create fractional shares and settle trades in real time. That means investors get the same exposure with more efficiency. Trades don’t have to wait for market hours to clear, and fund ownership can be updated instantly across digital systems.

This setup appeals to hedge funds, pensions, insurers, and corporates that are looking for safe, liquid places to park large cash balances. Unlike stablecoins, which pay no yield, tokenized money market funds allow idle capital to earn interest while keeping volatility low.

A recent report from Moody’s (MCO) showed these tokenized funds have already reached $5.7 billion in assets since 2021. Firms like Franklin Templeton and WisdomTree (WT) have also launched similar products. It’s now becoming a serious segment of the market, especially for institutions that want a connection between digital rails and traditional finance.

Goldman and BNY Shift Ownership Recording to the Blockchain

Goldman Sachs and BNY are building systems that let clients track fund ownership in real time. These tokenized money market funds will live on Goldman’s private blockchain, which means ownership is recorded instantly and updates as soon as a trade happens. That’s a major step up from traditional systems that rely on delayed clearing and batch processing.

By moving to blockchain, clients get 24/7 access. They don’t have to wait for markets to open or close, and settlement isn’t tied to business hours. This is especially useful for large institutions managing cash positions across different time zones.

Essentially, Goldman and BNY are rolling out services designed to fix specific issues: slow settlement, outdated record-keeping, and poor capital efficiency. These are problems that traditional finance has struggled with for decades, and blockchain infrastructure is being used to solve them at scale.

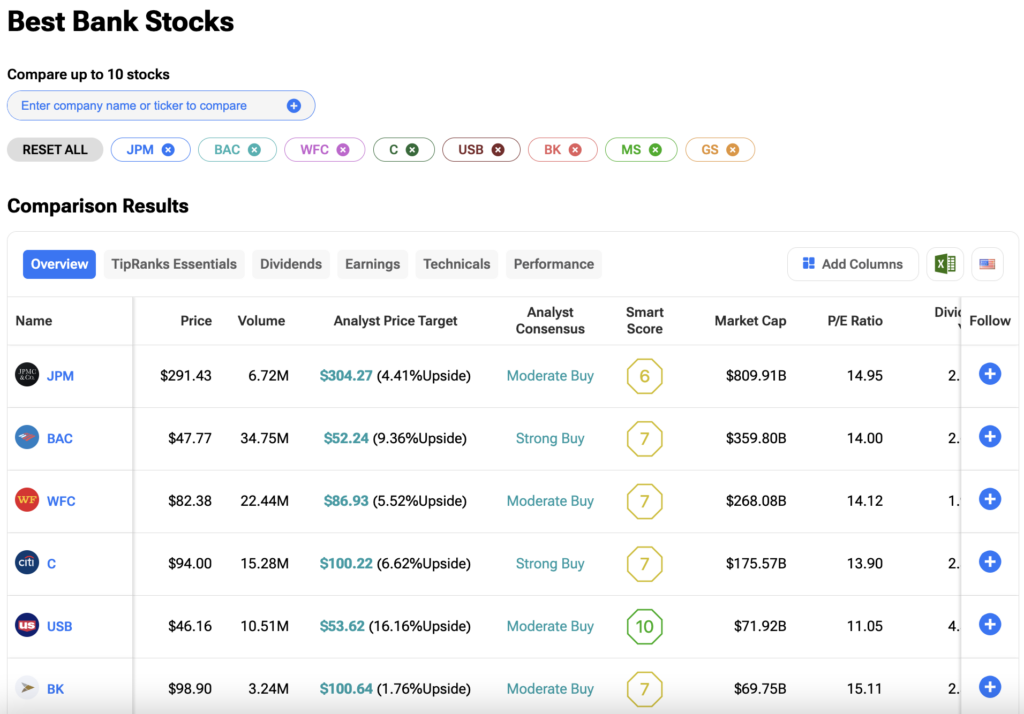

Investors can compare the Best Bank Stocks on the TipRanks Stocks Comparison tool. Click on the image below to find out more.