Marketing and comunications group Stagwell (STGW) wants to double the size of its business through an “aggressive” M&A drive.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Global Agencies in Play

Speaking to the Financial Times, the company’s founder and chief executive Mark Penn said he wanted to ramp up group revenues to around $5 billion from the $2.3 billion it reported in 2024. It would also give a boost to its current market valuation of $1.7 billion and its share price, which is down around 8% in the year to date.

Penn, former chief strategy officer at Microsoft (MSFT), is hoping to take advantage of uncertainty and upheaval at rival U.S. and U.K. agencies and scoop up companies both there and around the world. It was rumored last year that Stagwell had approached Sir Martin Sorrell’s advertising and marketing group S4 Capital in the U.K. about a deal. It is understood, however, that Stagwell was rebuffed.

Politics Pays in the U.S.

But don’t feel too sorry for the stock. As reported by the FT, STGW completed a grand total of 11 acquisitions last year across 13 countries. More are on the cards, but Penn said that it would be a controlled M&A push this year. He told the FT that his ideal position was to become a “Goldilocks” company, simply meaning neither too big nor too small.

Last month, the group reported fourth-quarter revenues of $788.7 million, beating consensus of $753.2 million. The febrile U.S. political environment was a key driver as Stagwell helped both political organizations and companies create communication strategies during the Presidential election.

Is STGW a Good Stock to Buy Now?

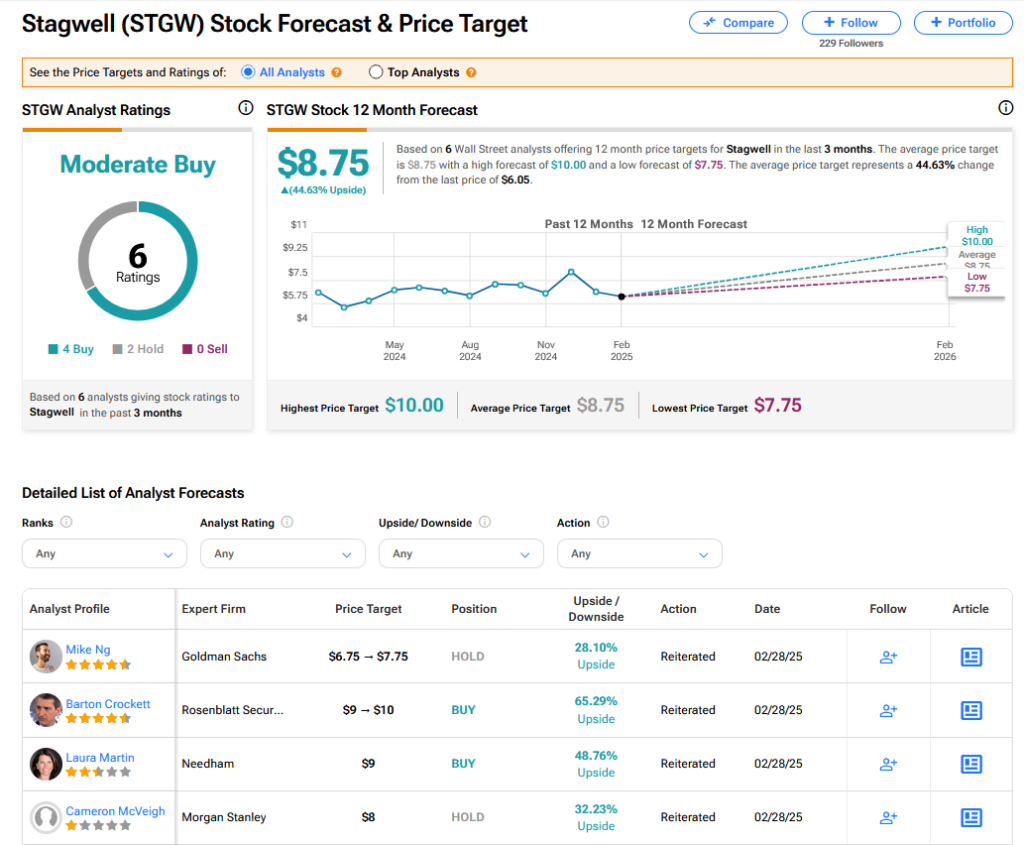

On TipRanks, STGW has a Moderate Buy consensus based on 4 Buy and 2 Hold ratings. Its highest price target is $10. STGW stock’s consensus price target is $8.75 implying an 44.63% upside.

Looking for a trading platform? Check out TipRanks' Best Online Brokers guide, and find the ideal broker for your trades.

Report an Issue