Both JP Morgan (JPM) and Morgan Stanley (MS) have offered new predictions about the price of gold. Although gold prices dropped on October 21, both banks expect a surge in 2026. JPM predicts prices reaching an average of $5,055 per ounce by the fourth quarter of 2026. MS is also optimistic, revising its 2026 gold forecast upward to $4,400 per ounce.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Both banks cited the expected interest rate reductions by the Federal Reserve as catalysts. Historically, gold prices have risen an average of 6% in the 60 days after the start of a Fed rate-cutting cycle. That’s due to gold becoming a more attractive investment once the return on cash and bonds drops.

Additionally, as Morgan Stanley writes in a report, slowed growth in the U.S. economy benefits gold. That’s because sluggish growth leads the U.S. dollar to weaken, prompting investors to shift from dollar-based assets to gold.

Explaining her position, Morgan Stanley strategist Amy Gower said, “We see further upside in gold, driven by a falling U.S. dollar, strong ETF buying, continued central bank purchases and a backdrop of uncertainty supporting demand for this safe-haven asset.”

Similarly, JP Morgan analysts wrote in a note, “With gold being our highest conviction long all year, we still believe it has even higher to go as we enter into a Fed cutting cycle.”

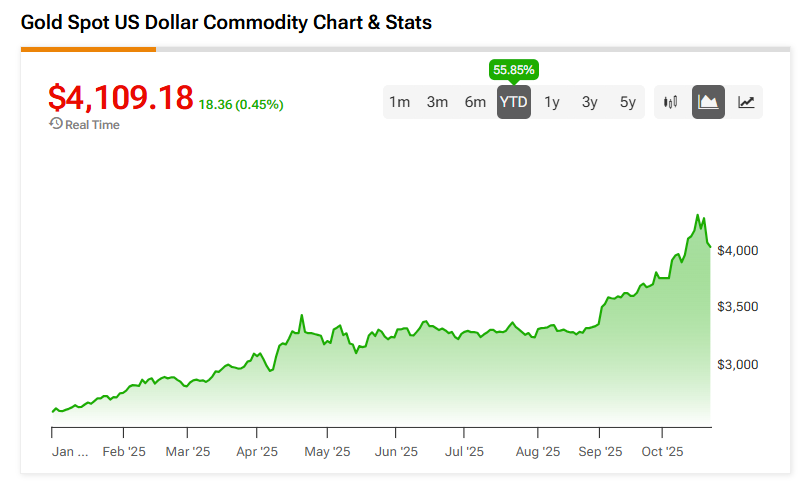

Gold Prices this Year

Gold is one of the best-performing assets of 2025, having appreciated by more than 50% this year.

Interested in investing in gold? See TipRanks’ Compare Gold ETFs chart for real-time data so you can research gold ETFs before you invest.