Gold prices are surging again boosted by U.S. economic fears and even a glimmer of hope that the long-running government shutdown is coming to an end.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Prices raced to a two-week high in early trading today as investors bet that the Federal Reserve would get past its wavering moment and cut interest rates next month.

Solid Gold

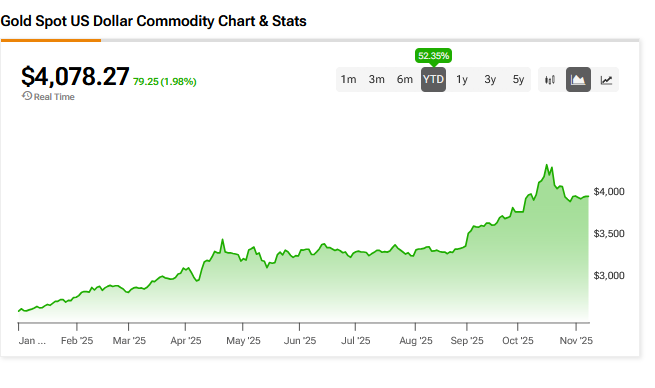

Gold futures rose by 1.8% to $4,084.20 per ounce, while spot gold climbed 2% to $4,081.64.

“Gold is catching a solid bid from traders to kick off the week, with the precious metal rising on anticipation that a rate cut could still arrive next month, even though the Fed has been downplaying the chances of it occurring,” said Tim Waterer, chief market analyst at KCM Trade.

Indeed, according to the CME FedWatch Tool, investors have assigned a 67% probability of a rate cut in December. Gold typically benefits from lower interest rates and periods of economic uncertainty.

Recent U.S. labor data figures have deepened economic gloom with reports of job losses in October especially in the government and retail sectors. Businesses have also announced a raft of layoffs as a result of cost-cutting and the growing use of artificial intelligence.

Shutdown Room

Consumer sentiment also weakened to its lowest level in nearly three-and-a-half years in early November, amid concerns about the impact of the longest government shutdown on record on the economy.

Over the weekend, there have been some signs of light at the end of the shutdown tunnel with the U.S. Senate reportedly close to advancing a measure to reopen the federal government.

“When the shutdown risk fades, investors often turn their attention back to the Federal Reserve’s policy outlook,” said Vasu Menon, an investment strategist at Oversea-Chinese Banking Corp. “If ending the shutdown means the government can release delayed economic data, it gives the Fed room to ease policy sooner if the data shows slowing growth.”

Gold has been on quite the tear this year – see above – as investors see it as a safe haven given economic shocks like the scale of President Trump’s tariffs and geopolitical events in the Ukraine and the Middle East.

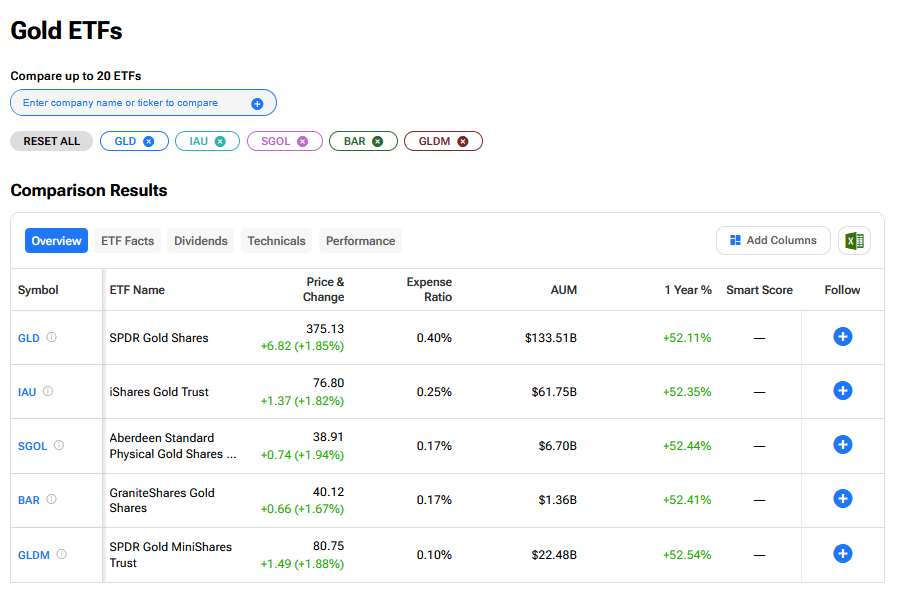

What are the Best Gold ETFs to Buy Now?

We have rounded up the best gold ETFs to buy now using our TipRanks comparison tool.