The gold price soared to another record high today as investors fretted about alleged U.S. government interference in the independence of the Federal Reserve.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

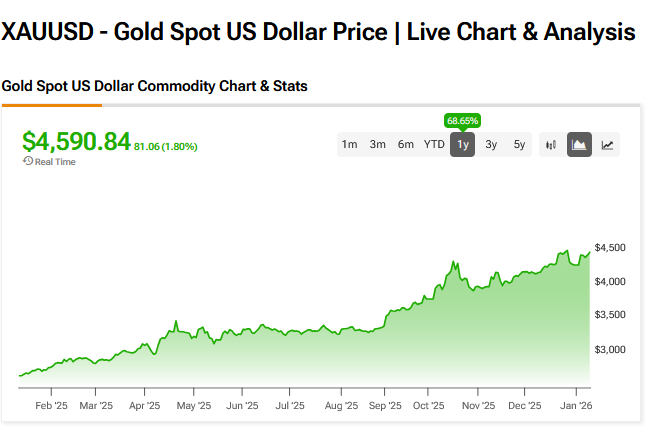

Gold futures jumped 2% to $4,592.90 per ounce in early trading, while spot gold surged 1.8% to $4,590.

Safest of Havens

Investors sought out the precious metal as a safe haven on news that a criminal probe had been opened into the Federal Reserve chair Jerome Powell.

Powell revealed at the weekend that the Justice Department served the central bank with grand jury subpoenas, threatening a criminal indictment related to the Chair’s testimony before the U.S. Senate.

“The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the president,” Powell said.

Investors took fright on what this could mean for the Fed moving forward.

“Investors feared about the independence of the Federal Reserve,” said Russ Mould, investment director at AJ Bell. “The probe has unnerved markets and raised questions about what might happen to the Fed once Powell steps down in May. There is a fear that President Trump is meddling too much with policies that are meant to be set independently. Gold is an asset with safe-haven qualities that often shines in an uncertain market.”

Fears over Iran Conflict

Geopolitical fears were also behind the surge in the gold price. This is mainly centered around the recent events in Iran where hundreds of people have reportedly been killed in anti-government protests. Trump has said that the U.S. is considering some “very strong options” in Iran, with the leaders in Tehran in turn threatening Israel and U.S. interests in the region.

“Escalating rhetoric between Iran and the U.S., alongside revelations that chair Powell faced threats from the White House over past decisions, heightened the sense of political risk,” said Matt Britzman, senior equity analyst at Hargreaves Lansdown. “A softer U.S. jobs print on Friday added fuel to the gold trade, with traders leaning into expectations of two rate cuts this year ahead of a pivotal inflation report later this week.”

Gold, and linked ETFs such as the SPDR Gold Shares ETF (GLD), have been on quite the tear over the last 12 months – see above. A number of analysts have predicted that it will hit the magical $5,000 mark this year.

What are the Best Gold ETFs to Buy Now?

We have rounded up the best gold ETFs to buy now using our TipRanks comparison tool.