Gold mining stocks lost their shine today despite the price of the precious metal continuing to soar towards the historic $4,000 an ounce mark.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Barrick Mining (B) was down over 2% in pre-market trading with Newmont Mining (NEM) off 1.8%, Franco-Nevada (FNV) 0.9% lower and Kinross Gold (KGC) down 2.3%.

Expectations Building

The drops came despite the spot gold price racing to another record high of $3,871. It has already grown almost 50% since the start of the year – see below – with expectations building that it could soon hit the magical $4,000.

“In trading rooms, gold is no longer just a hedge; it’s become the star performer, the undisputed heavyweight,” said SPI Asset Management’s Stephen Innes. “Every desk is watching because when gold is surging, it tends to reveal more about political and policy anxiety than about jewelry demand.”

Russ Mould, investment director at AJ Bell, added: “The precious metal has doubled in price in two years, driven higher by a cocktail of central bank buying, geopolitical risks and concern about government debt in the developed world. Miners stand to benefit from the gold price strength.”

For the last few months they certainly have with Barrick’s share price surging 117% since the start of 2025 and Newmont Mining up an even more impressive 130%.

Shutdown Impact

However, it looks like today another driver of the gold price has not rubbed off so well on the mining stocks.

The potential U.S. government shutdown and the impact that will have on non-essential services, as well as the release of key economic data will add to the continued uncertainty which gold investors thrive on.

Gold is traditionally seen as a safe haven during troubled times which the world is certainly experiencing at the moment with economic uncertainty and geopolitical risks from Ukraine, to the Middle East and Taiwan.

The shutdown, however, has taken the shine off previously surging equity markets and could be the reason why the mining stocks are lower today. Investors may also have been taking profits given the recent rise.

However, given forecasts that the gold price could soar beyond $4,000 next year to $4,500 and even hit $5,000 if investors keep piling into the precious metal, miners look in a prime position.

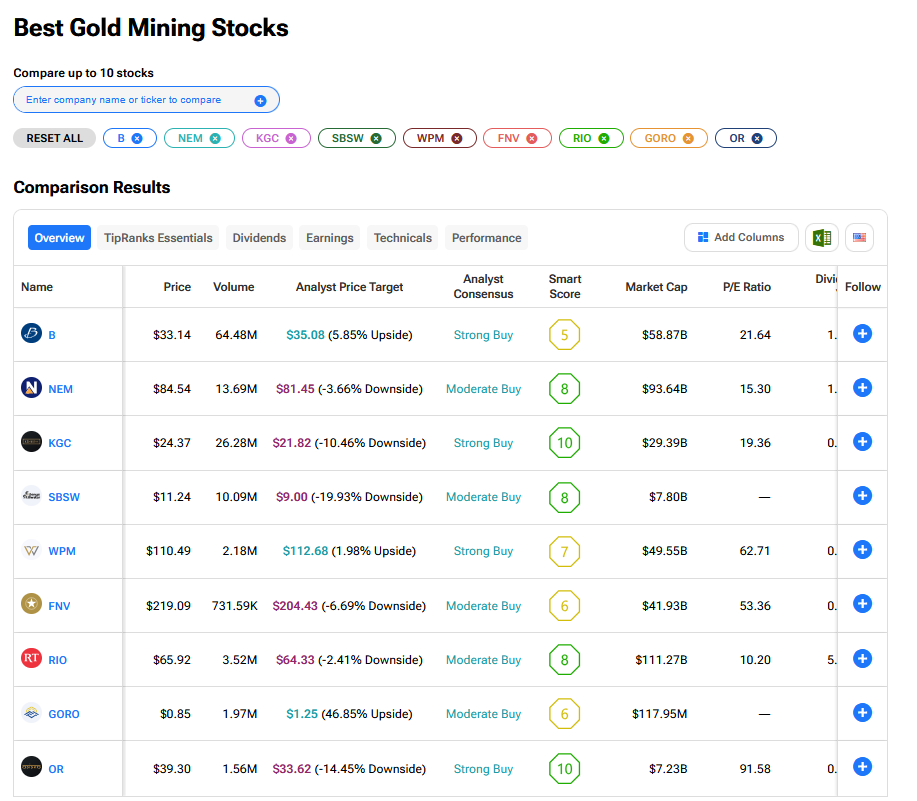

What are the Best Gold Mining Stocks to Buy Now?

We have rounded up the best gold mining stocks to buy now using our TipRanks comparison tool.