Canadian gold miner Barrick (B) has raised its quarterly dividend by 25% and increased its stock buybacks after reporting strong financial results for this year’s third quarter.

TipRanks Cyber Monday Sale

- Claim 60% off TipRanks Premium for data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

Barrick continues to benefit from strong gold prices, which hit an all-time high of just over $4,300 an ounce in recent months. As such, the Toronto-based company reported earnings per share (EPS) of $0.58, which beat analysts’ average expectation of $0.57.

Revenue for the quarter ended Sept. 30 was $4.15 billion, up from $3.37 billion a year earlier. However, the Q3 sales figure fell short of the $4.40 billion forecast on Wall Street. Still, Barrick’s Q3 gold production rose 4% from this year’s second quarter and totaled 829,000 ounces. This helped the company report record quarterly operating cash flow and free cash flow of $2.4 billion and $1.5 billion, respectively.

Dividend and Share Repurchase

Barrick is using the record cash flow to hike its distribution to shareholders. Moving forward, the company will pay a quarterly dividend of $0.125 per share, up 25% from the previous amount. Barrick also said it plans to pay a special, one-time dividend of $0.05 per share, bringing its total payout for the current quarter to $0.175 a share.

Additionally, Barrick’s board of directors has approved a $500 million increase to the existing share repurchase program. The company has bought back shares worth $1 billion year to date. The $500 million expansion brings the remaining amount on the current share repurchase program to $1.5 billion. B stock is up 5% on Nov. 10 on news of the dividend and share repurchase increases.

Is B Stock a Buy?

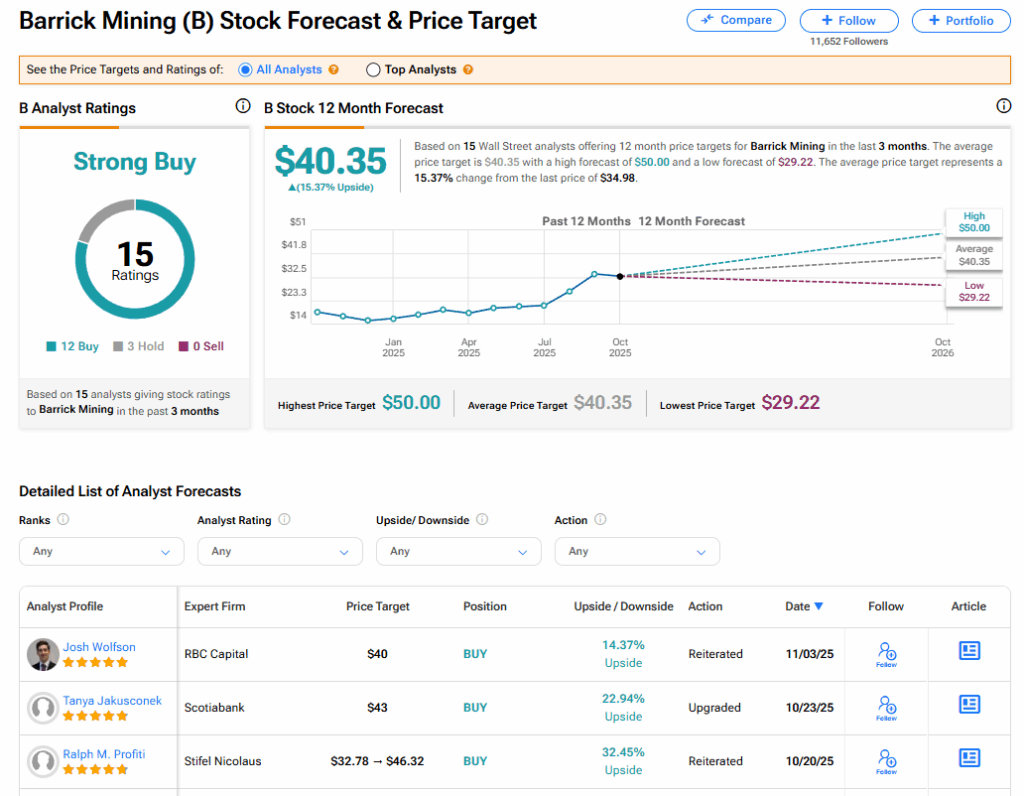

Barrick Mining’s stock has a consensus Strong Buy rating among 15 Wall Street analysts. That rating is based on 12 Buy and three Hold recommendations issued in the last three months. The average B price target of $40.35 implies 14.37% upside from current levels.