The gold price has rocketed past the $4,000 mark for the first time ever as investors increasingly see it as a safe haven in a time of crisis.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Record Breakers

The spot gold price reached $4,044 an ounce in early trading. The price has continued to rise steadily this year, setting new record after new record – see below:

It has been driven higher by a number of economic and geopolitical factors. These include President Trump’s tariff trade wars, a global economic slowdown, interest rate cuts, a weak dollar, the U.S. government shutdown and wars in Ukraine and the Middle East.

At times such as these, investors see gold as a safe place to park their cash.

AI Link?

In addition, some analysts say that gold has become a collective hedge against the possible implosion of the AI-driven boom for technology stocks in the US.

A recent report from the Massachusetts Institute of Technology found that 95% of businesses that had integrated AI into their operations had yet to see any return on their investment.

The AI sector wobbled yesterday after Oracle (ORCL) reported thinner-than-expected profit margins from its cloud business. “The fact that this deal may be slow to pay off could unnerve investors, especially since the biggest listed hyperscalers, including Microsoft (MSFT), Alphabet (GOOGL), Meta Platforms (META) and Amazon (AMZN), have spent a combined $300 billion this year alone on capex spending for AI,” said Kathleen Brooks, research director at XTB.

Shiny Future

Ahmad Assiri, research strategist at the spread betting provider Pepperstone, said the fundamental drivers of the precious metal remain solid: “Selling gold at this stage has become a high-risk endeavour for one simple reason, conviction. Institutions, central banks and retail investors alike now treat dips as a buying opportunity rather than a sign of exhaustion. One only needs to recall the $3,000 level just six months ago, reached amid the tariff headlines, to understand how sentiment has shifted,” he said.

The prospects of gold zooming even higher are strong. Investment bank Goldman Sachs recently forecasted that it could hit an unprecedented $5,000 an ounce by the end of next year.

The bank lifted its end of 2026 forecast to $4,900 an ounce from previous expectations of $4,300 an ounce. Goldman said the demand for gold was “sticky”, driven by central bank buying, including the People’s Bank of China, and Western investors putting their cash into gold-linked ETFs.

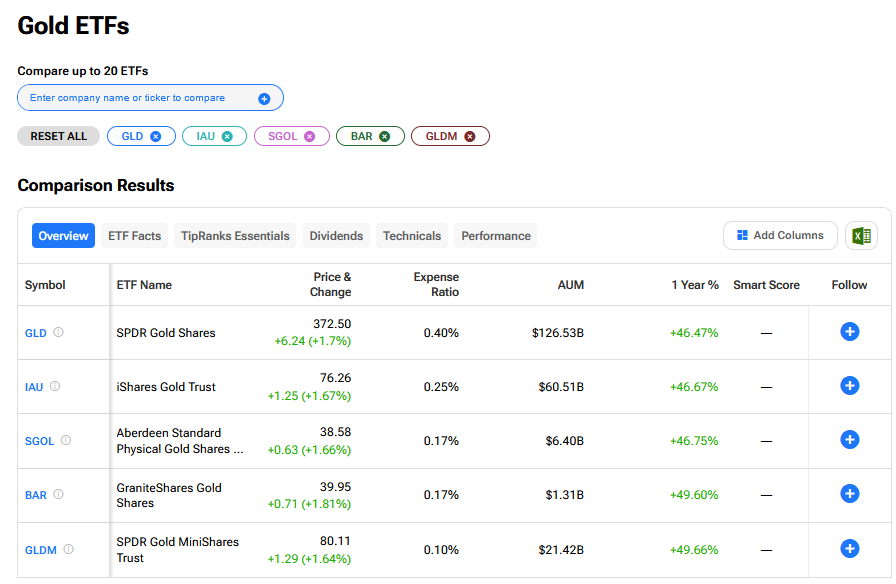

What are the Best Gold ETFs to Buy Now?

We have rounded up the best gold ETFs to buy now using our TipRanks comparison tool.