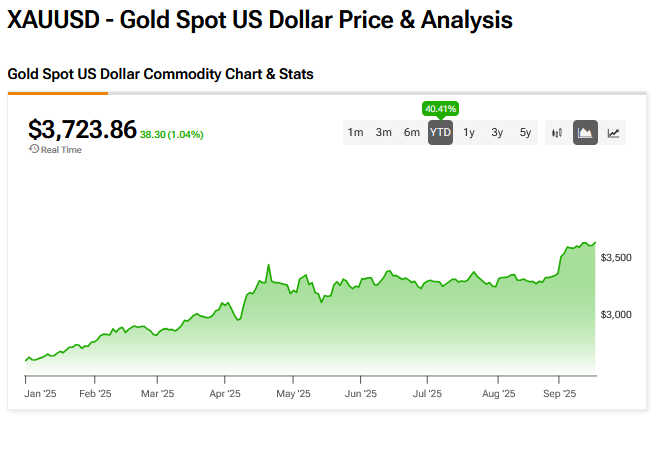

Gold prices raced to a record high today as investors flocked to the safe haven metal buoyed by the hope of further interest rate cuts.

TipRanks Black Friday Sale

- Claim 60% off TipRanks Premium for the data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

In early trading gold futures had gained 1.1%, reaching $3,745.90 per ounce, while the spot gold price roared to new heights of $3,723.86.

Finding Feet

“Gold is finding its feet again today, with traders focusing on upside price potential between now and year-end fuelled by projected further rate cuts from the Fed,” said KCM Trade chief market analyst Tim Waterer. He added that sustained central bank buying also continued to support gold’s momentum.

AJ Bell investment director Russ Mould said: “The traditional safe-haven asset is benefiting from hopes for further rate cuts as well as continuing geopolitical uncertainty.”

Expectations of rate cuts have bolstered demand for gold, which tends to look more attractive during times of low interest rates . A weaker US dollar, another consequence of rate cut expectations, has also made the metal more attractive to buyers holding other currencies.

Further Hikes

Leading bank Goldman Sachs has forecast that these drivers, in addition to geopolitical uncertainty, could see the gold price zoom past $4,500 an ounce next year and even hit $5,000 if investors keep piling into the precious metal.

It forecasted that gold could hit $3,700 by the end of 2025 and $4,000 by mid-2026.

Deutsche Bank has forecast that the gold price will race to $4,000 in 2026 buoyed by strong demand from central banks given global uncertainty and interest rate cuts.

The bank upped its forecast from a previously expected $3,700 in April in anticipation of a series of interest rate cuts by the Federal Reserve this year.

Gold has already been on quite the march this year rising 40% so far. This has also buoyed ETFs linked with the market.

The SPDR Gold Shares ETF (GLD) is up 40% this year with the VanEck Gold Miners ETF (GDX) accelerating 113%.

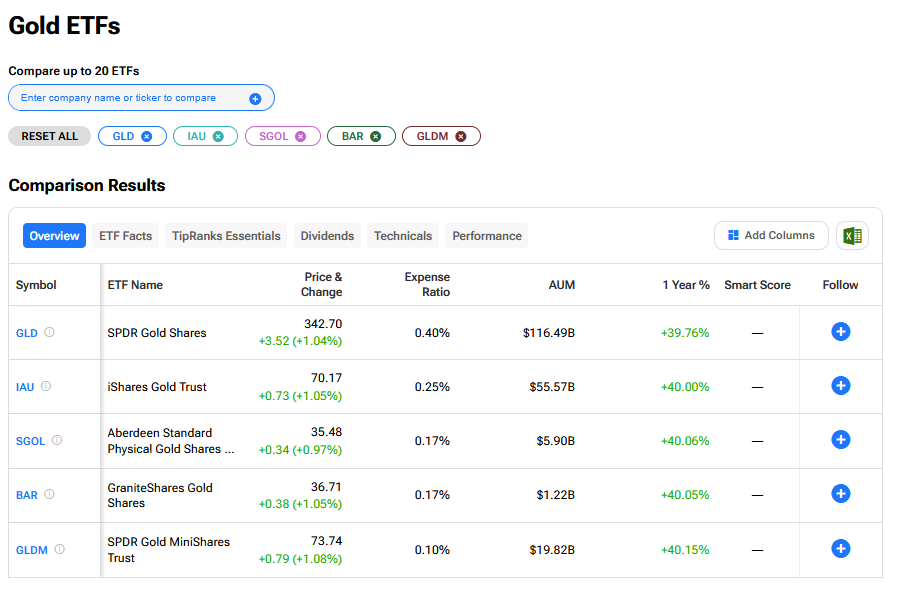

What are the Best Gold ETFs to Buy Now?

We have rounded up the best Gold ETFs to buy now using our TipRanks comparison tool.