GoGold Resources (TSE: GGD), a Canada-based silver and gold producer with projects in Mexico, has provided an outlook on 2022 milestones and deliverables, as well as a review of 2021.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

2022 Key Milestones

GoGold has an aggressive exploration program targeting substantial growth in district-wide resource ounces, including 100,000 meters of drilling north and south of Los Ricos.

Mineral resource estimates at Los Ricos North and Los Ricos South have been updated before year-end. In addition, a pre-feasibility study is being completed in Los Ricos South.

In 2022, the company will focus on an aggressive drilling and exploration campaign to increase the mineral resource estimate of the Los Ricos North property. The main areas of intervention of this program will be El Favor East and Gran Cabrera.

Management Commentary

GoGold president and CEO Brad Langille said, “2021 was a transformative year for the Company, with significant milestones achieved including more than doubling the Company’s Resources with our initial Mineral Resource Estimate at Los Ricos North, and a Preliminary Economic Assessment at Los Ricos South released. These were catalysts for the Company which helped to generate significant returns for our shareholders.”

Wall Street’s Take

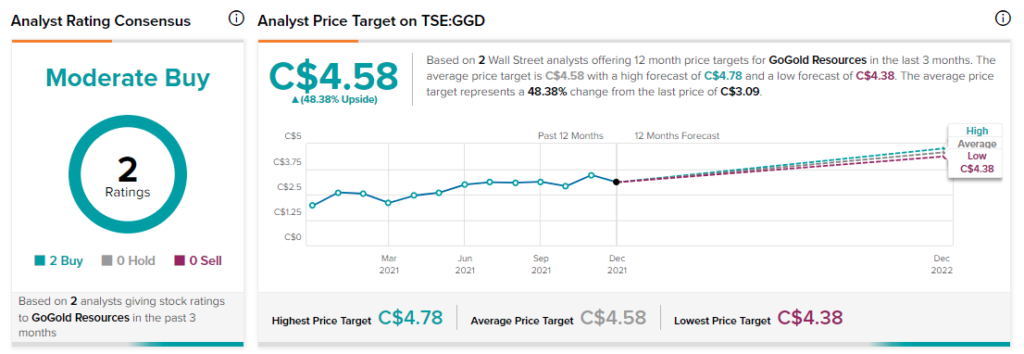

On December 17, BMO Capital analyst Ryan Thompson maintained a Buy rating on GGD and set a price target of C$4.40. This implies 42.4% upside potential.

Overall, consensus on the Street is that GGD is a Moderate Buy based on two Buys. The average GoGold Resources price target of C$4.58 implies 48.4% upside potential to current levels.

Download the mobile app now, available on iOS and Android.

Related News:

Lundin Mining to Buy Josemaria Resources; Shares Plunge

CP Rail Completes KCS Acquisition; Shares Pop