Penny stock Canoo (NASDAQ:GOEV) declined 3.2% in yesterday’s extended trading session following the release of weaker-than-expected first-quarter results. The company’s performance was impacted by slowing demand for electric vehicles (EVs) and intense competition, particularly from Chinese auto companies.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Canoo is an American EV startup that produces innovative and subscription-based mobility solutions.

GOEV’s Q1 Highlights

The company reported an adjusted loss of $1.13 per share, which was greater than the consensus estimates of a loss of $0.97. However, the reported figure compared favorably with a loss of $1.73 reported in the prior-year quarter.

Meanwhile, Canoo failed to report any revenues for the first quarter, missing Wall Street’s expectations of $1.1 million.

In terms of balance sheet figures, the company’s cash position showed improvement on a sequential basis. As of March 31, cash and cash equivalents came in at $18.2 million, compared with $6.4 million at the end of December 2023.

2024 Outlook

Canoo reaffirmed its 2024 outlook and expects its revenue to be between $50 million and $100 million. The consensus estimate is pegged at $68.7 million.

Moreover, the company forecasts that cash outflows will be in the range of $45 million to $75 million.

Is GOEV a Good Stock to Buy?

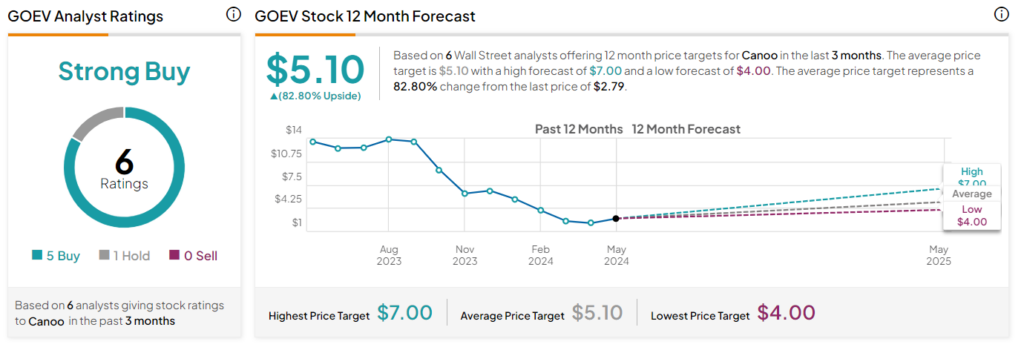

Based on five Buys and one Hold recommendation, the stock has a Strong Buy consensus rating. The analysts’ average price target on Canoo stock of $196.75 implies a limited upside potential of 2.7% from current levels. Shares of the company have declined by 53% so far this year.