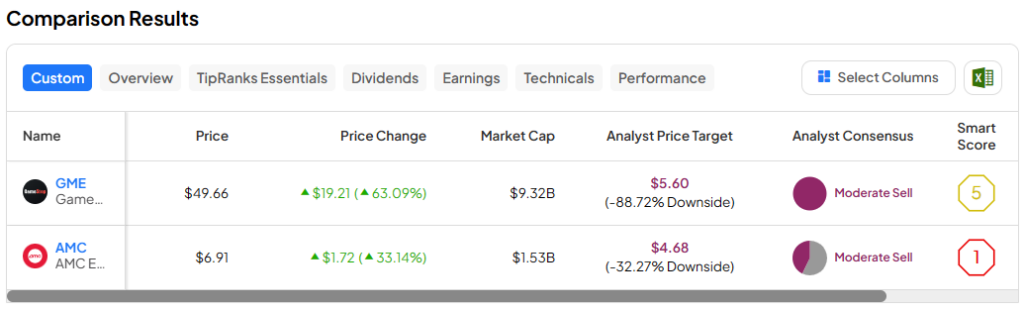

In this piece, I evaluated the two original meme stocks, GameStop (NYSE:GME) and AMC Entertainment (NYSE:AMC), using TipRanks’ Comparison Tool below to see which is better. In an attempt to be a voice of reason amid all the excitement and volatility, I suggest bearish views for both.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

GameStop sells video games and consumer electronics, while AMC Entertainment operates a chain of movie theaters. They were the first two stocks drawn into the meme-stock frenzy that began in early 2021. That’s when the X user known as “Roaring Kitty” originally posted some remarks about them on the WallStreetBets Reddit (NYSE:RDDT) forum, triggering a massive frenzy as retail investors targeted heavily shorted stocks such as GME and AMC.

On Monday alone, GameStop shares surged 98%, extending their five-day gain to 219%. The stock is now up 200% year-to-date and 153% over the last 12 months after recovering from last year’s losses. It was a similar story with AMC Entertainment stock, which soared 121% on Monday. AMC shares are up roughly 200% over the last five days and 60% year-to-date, although they’re actually in the red over the last year, off 78%.

Those blistering rallies in the companies’ share prices were the result of a single social media post by “Roaring Kitty” (aka, Keith Gill, who uses the name DeepF******Value on Reddit). He didn’t actually say anything in that post but merely posted a picture of someone playing a video game and leaning forward as if they were re-engaging with the game. That image ignited rumors that he was returning to the market, and afterward, he began posting edited movie clips about characters going back into action.

Given that the valuations of meme stocks like these are entirely divorced from fundamentals — and reality — a discussion of commonly used metrics like price-to-earnings (P/E) ratios is unhelpful. However, there are other factors to look at.

GameStop (NYSE:GME)

To illustrate just how ridiculous GameStop’s stock price has become after Monday’s explosion, the declining video game retailer’s P/E soared as high as 1,387.2 (not a typo). Between that obscene valuation, which boosted GameStop’s market capitalization to $9.3 billion (now at $15.5 billion when factoring in today’s gains), and the fact that the retailer captured hardly any net income for all of 2023, a bearish view is absolutely appropriate.

A review of GameStop’s fourth-quarter and full-year earnings report reveals a steady slide in sales and earnings, so it isn’t deserving of the massive run-up in its shares. The only good news was that the retailer swung to a small net profit in 2023 after posting a net loss of $313.1 million for Fiscal 2022.

However, this is a company with steadily declining sales and extremely high expenses. In fact, GameStop’s net sales for Fiscal 2023 amounted to $5.3 billion, but its expenses are so high that its net income was less than $7 million for the whole year.

Thus, it’s no surprise that short interest in GameStop remains high. According to FactSet, about 24% of the retailer’s float, or tradable shares, was sold short as of Monday. FactSet‘s data also indicates that short interest in GameStop has hovered between the high teens and low 20s since early 2022.

In other words, the retailer’s meme-stock status has not kept short sellers away — despite what happened to hedge funds like Melvin Capital in the first go-around with retail traders. Melvin Capital had a sizable short position in GameStop in 2020 and 2021, meaning it had borrowed a large number of shares at what it hoped was a high price in anticipation of a precipitous drop in the stock’s price.

Unfortunately, Melvin Capital sustained a massive loss when retail investors triggered a short squeeze by buying up as many shares of GameStop as they could afford. As a result, Melvin required a nearly $3 billion bailout from other funds, including Point72 and Citadel.

The fund’s near-collapse should serve as a lesson for investors about using leverage to short a stock. Melvin Capital’s ADV showed it was highly leveraged going into the GameStop short squeeze. It’s just never a good idea because it’s never wise to invest more than you can afford to lose.

What Is the Price Target for GME Stock?

GameStop has a Moderate Sell consensus rating based on zero Buys, zero Holds, and one Sell rating assigned over the last three months. At $5.60, the average GameStop stock price target implies downside potential of 88.8%.

AMC Entertainment (NYSE:AMC)

Unlike GameStop, AMC Entertainment isn’t profitable. It’s also taking different steps as it tries to right the ship, including debt management. In March, the theater operator reported its best domestic box-office receipts since 2019, which is an excellent sign of recovery, but after Monday’s rocket-ship ride to the stars, a bearish view is appropriate.

According to S3 Partners, short interest in AMC stands at about 19% of the float. Due to the high short interest in AMC and GameStop, more short squeeze potential is likely, but that isn’t a good reason to buy any shares.

The good news is that AMC is starting to show some signs of life. The company improved its debt situation by paying off its $225 million senior secured revolving credit facility and deciding not to renew it, choosing instead to enter into a new letter-of-credit facility. AMC also grew its market share in 2023 and narrowed its quarterly loss in its latest earnings release.

However, it still has a long road ahead, so the average investor may not want to scoop up any shares anytime soon.

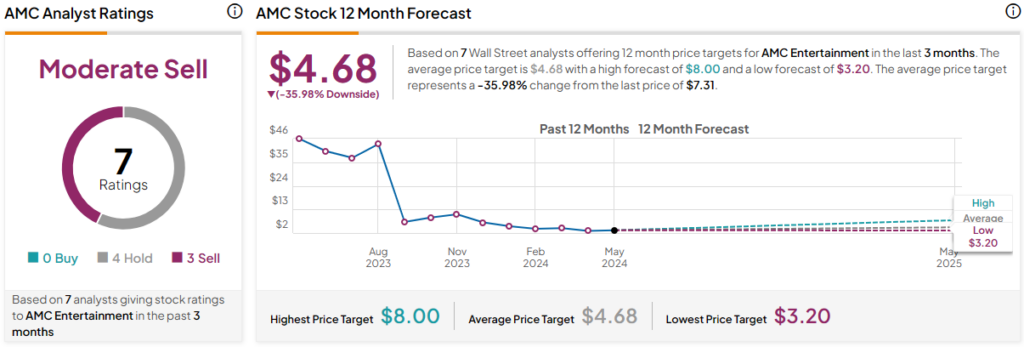

What Is the Price Target for AMC Stock?

AMC Entertainment has a Moderate Sell consensus rating based on zero Buys, four Holds, and three Sell ratings assigned over the last three months. At $4.68, the average AMC stock price target implies downside potential of 36%.

Conclusion: Bearish on GME and AMC

It’s unfortunate, but neither of these companies is healthy. The only thing driving their share prices higher now is the reignited meme-stock frenzy, which means buying either of these stocks now is like trying to catch a falling knife.

Picking a winner here depends entirely on what you feel is most important. Investors who prefer to emphasize bottom-line improvements might choose GameStop, while those who focus more on other factors like debt management, improving margins, and market share might prefer AMC.

Personally, I’m in the latter camp because such measures may have longer-lasting effects than simply cutting costs, but I still wouldn’t buy any shares of either at current prices.