Video game retailer GameStop (GME) has reported mixed financial results for this year’s third quarter amid an ongoing decline in its sales.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The company reported earnings per share of $0.06, which was much better than a loss of of -$0.03 that was the consensus forecast on Wall Street. However, revenue in the July through September period totaled $860.3 million, which missed analyst expectations that called for $888 million. Sales were down 20% from a year earlier.

Owing largely to the surprise profit, GME stock is up 3% in after hours trading. As is customary for the company, GameStop did not schedule a news conference or an earnings call with analysts and investors to discuss its latest financial results.

Equity Offerings

In its earnings release, GameStop said that it had completed an at-the-market equity offering that saw it sell 20 million shares of common stock. The company said that it doesn’t anticipate any further equity offerings during the current Fiscal year.

While sales of video games at brick-and-mortar retail outlets continue to decline, GME stock is nevertheless up 54% this year and on pace for its best annual performance since 2021, when the share price soared nearly 700%. Most of this year’s gain came in the spring when meme-stock celebrity Keith Gill, known online as “Roaring Kitty,” returned to social media and hyped GME stock.

Since mid-May, the company’s share price has declined nearly 45%.

Is GME Stock a Buy?

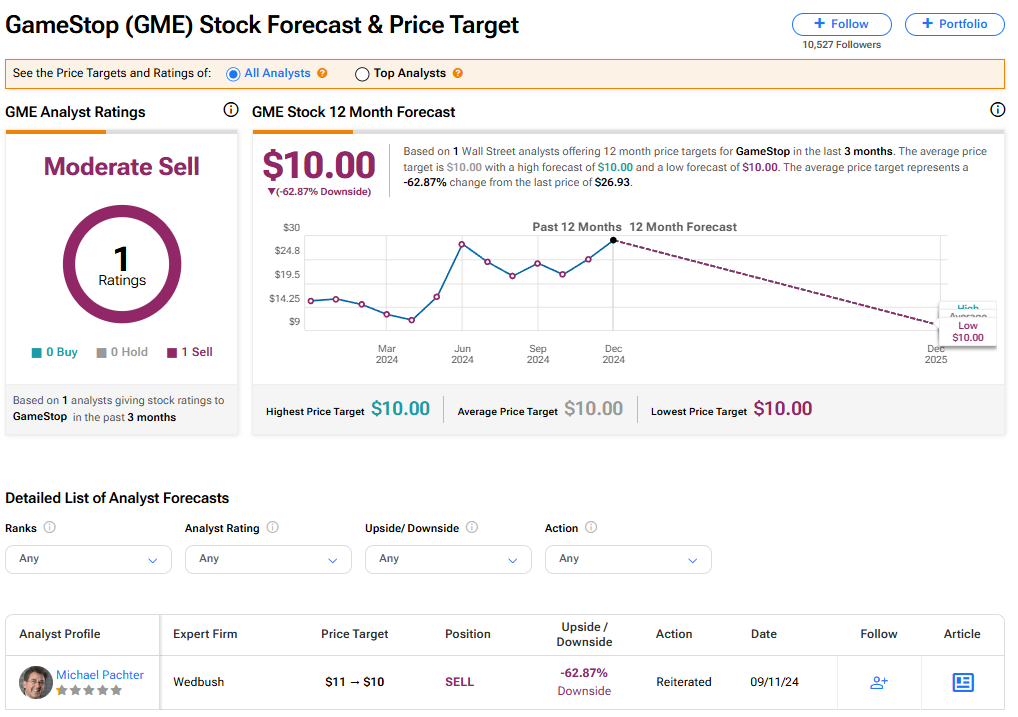

Only one analyst currently rates GME stock, Michael Pachter at Wedbush Securities. He has a Moderate Sell recommendation on the stock. His price target of $10 implies 62.87% downside risk from current levels.