Legacy automaker General Motors (GM) is pivoting its investments toward combustion engines with a new $888 million commitment. The company plans to use the funds to boost production of its latest V-8 engines at its Tonawanda propulsion plant in Buffalo, New York. In 2023, GM had originally planned on investing $300 million for producing electric vehicle (EV) motors at the same facility.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

GM Reverses Course on EV Plans

Contrary to expectations, demand for EVs has slowed down drastically. This has prompted GM to reconsider its strategy and reinvest in the traditional combustion engine market instead of the EV sector. On Tuesday, GM said that this new plan represents its largest single investment in an engine plant. The Tonawanda propulsion plant will produce the advanced sixth generation of V-8 engines for use in full-size trucks and sports utility vehicles (SUVs).

Currently, the plant manufactures the fifth generation of the V-8 engines, but beginning in 2027, it will start producing the sixth generation of these engines. These new engines will combine the power of advanced combustion and thermal management innovations, which will enhance the engine performance while reducing carbon emissions.

The funds will be used for new machinery, equipment, tools, and facility renovations. This investment displays GM’s renewed commitment to U.S. manufacturing and supporting local employment. GM has been one of the fastest automakers to adapt to the EV transition. It already has about a dozen EVs running on the streets in the U.S. Even so, the changing dynamics of the EV sector are forcing the company to change its course on EVs and turn to legacy combustion motors.

Is GM Stock a Buy Now?

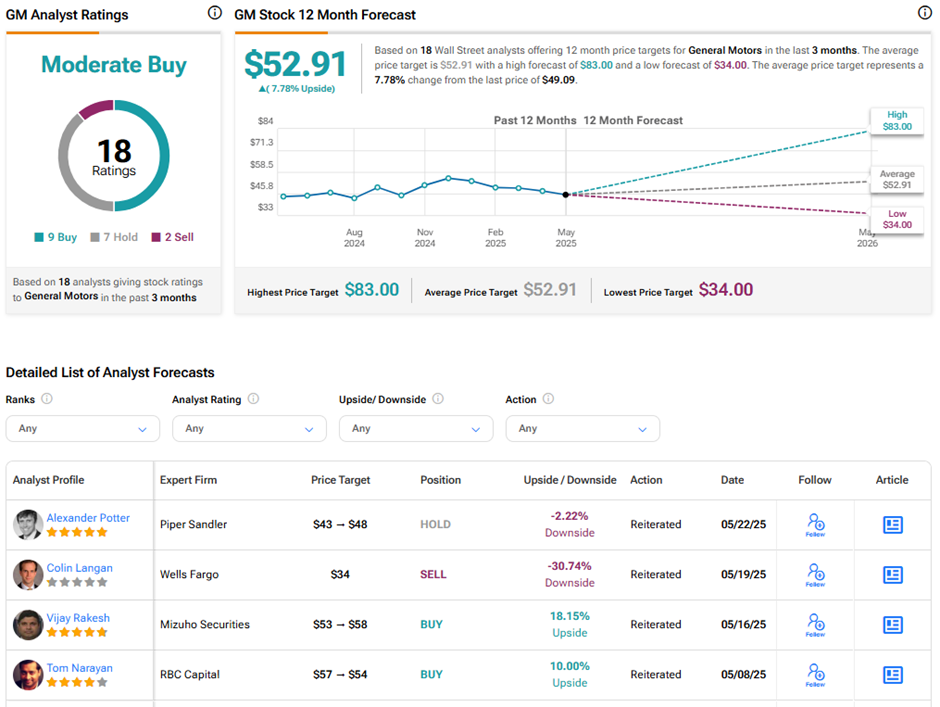

Analysts remain divided on General Motor’s long-term stock trajectory. On TipRanks, GM stock has a Moderate Buy consensus rating based on nine Buys, seven Holds, and two Sell ratings. Also, the average General Motors price target of $52.91 implies 7.8% upside potential from current levels. Year-to-date, GM stock has lost 7.6%.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue