U.S. President Donald Trump has said he plans to implement new tariffs on imported motor vehicles starting on April 2 of this year.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Trump’s comment on auto tariffs contained few other details, and did not say whether the new duties will apply to all automotive imports. Trump continues to advocate tariffs as a way to raise revenue, remedy trade imbalances, and pressure countries to act on U.S. concerns.

However, economists and industry analysts continue to sound the alarm, warning that tariffs raise prices for American consumers. Analysts and automotive executives have been particularly critical of potential tariffs on motor vehicles, saying they will sharply raise the price of cars sold in the U.S. and damage the auto manufacturing industry that is closely intertwined with Canada and Mexico.

Growing Concerns

About half of all the vehicles sold in the U.S. are manufactured within the country. The other 50% are imported from Mexico and Canada, as well as major auto-producing nations such as Japan, South Korea, and Germany.

The three major North American automotive manufacturers, General Motors (GM), Ford Motor Co. (F) and Stellantis (STLA) have raised concerns about potential tariffs, with Ford CEO Jim Farley being particularly vocal on the issue. Farley has criticized Trump’s proposed tariff of 25% on Mexico and Canada, saying it will “blow a hole” in the North American auto industry.

The American Automotive Policy Council, which represents GM, Ford and Stellantis, has publicly called for Trump to drop his proposed tariffs on Mexico and Canada, saying it could be potentially devastating.

Is F Stock a Buy?

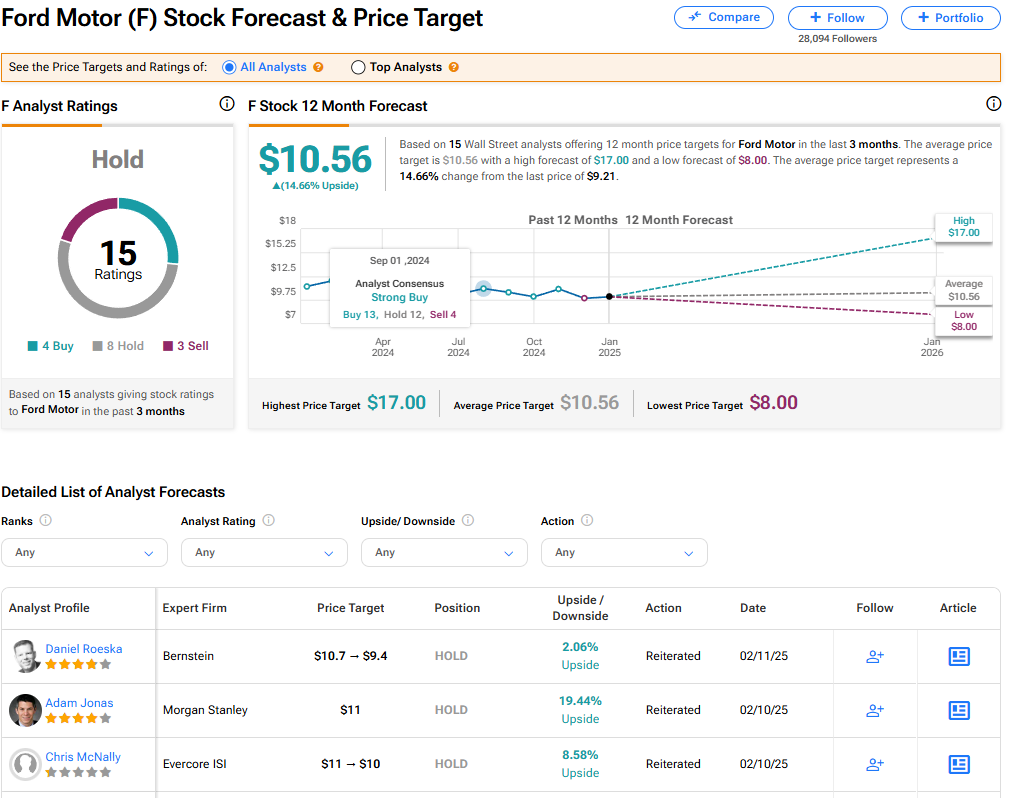

The stock of Ford Motor Co. has a consensus Hold rating among 15 Wall Street analysts. That rating is based on four Buy, eight Hold, and three Sell recommendations issued in the last three months. The average F price target of $10.56 implies 14.66% upside from current levels.