General Motors Co. (GM) reported robust results for the second quarter. The automobile giant’s adjusted earnings per share came in at $3.06, marking a 60.2% increase year-over-year and surpassing analysts’ consensus estimate of $2.71 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company generated revenues of $47.97 billion in the second quarter, up by 7.2% year-over-year. This beat analysts’ expectations of $45.51 billion. In the second quarter, GM delivered 696,086 vehicles in the U.S., marking a 0.6% increase. The company also led the market in sales of full-size pickup trucks. In addition, the company’s Cruise autonomous driving unit is planning to expand testing in new cities, with supervised testing currently occurring in Phoenix, Dallas, and Houston. The Cruise autonomous driving unit had hit a pause on testing its cars after a string of accidents last year.

GM’s Dividend and Stock Buybacks

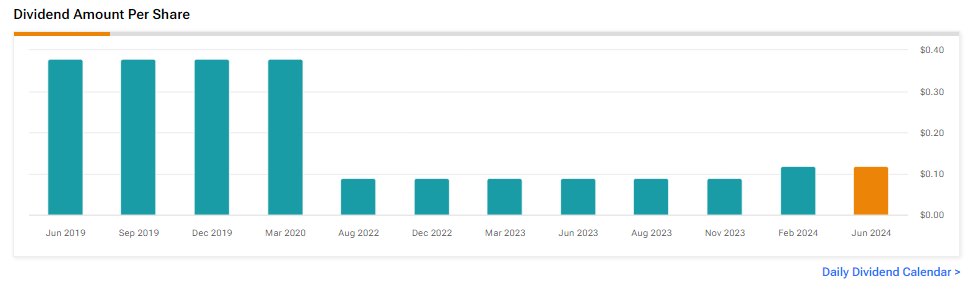

In June, GM authorized a stock buyback plan worth $6 billion. The company’s Board of Directors declared a quarterly dividend of $0.12 per share, payable September 19 to all common shareholders of record as of the close of trading on September 6, 2024.

The company’s CFO, Paul Jacobson, highlighted that strength in GM’s internal combustion engine (ICE) business is generating significant free cash flow, resulting in the company returning cash in the form of buybacks to shareholders.

GM Raises FY24 Outlook

Looking forward, GM raised its FY24 forecast for the second time this year, citing strong vehicle demand. The management now expects adjusted earnings per share for FY24 to be in the range of $9.50 to $10.50 per share, compared to its prior forecast of $9.00 to $10.00 per share. GM has projected adjusted EBIT between $13 billion and $15 billion, versus its prior forecast in the range of $12.5 billion to $14.5 billion.

Additionally, GM anticipates capital spending between $10.5 billion and $11.5 billion, “inclusive of investments in the company’s battery cell manufacturing joint ventures.” Furthermore, GM expects to produce 200,000 to 250,000 EVs this year.

Is GM a Good Stock to Buy Today?

Analysts remain cautiously optimistic about GM stock, with a Moderate Buy consensus rating based on 11 Buys, three Holds, and one Sell. Over the past year, GM has increased by more than 25%, and the average GM price target of $55.54 implies an upside potential of 12.1% from current levels. These analyst ratings are likely to change following GM’s Q2 results today.