Shares of General Motors (GM) gained in pre-market trading after the company reported robust third-quarter results. The automotive manufacturing company’s adjusted earnings increased by 29.8% year-over-year to $2.96 per share, exceeding analysts’ expectations of $2.38 per share.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Furthermore, the company’s revenues grew by 10.5% year-over-year to $48.78 billion in the third quarter, surpassing consensus estimates of $44.67 billion.

GM’s CEO Comments on the Results

GM’s CEO, Mary Barra, wrote in her letter to shareholders that, even amid fierce competition and a tough regulatory environment, the company is “focused on optimizing our ICE margins [margins from its internal combustion engine vehicles business] and working to make our EVs profitable on an EBIT basis as quickly as possible.”

Furthermore, the company’s CFO, Paul Jacobson, commented that the average transaction price per vehicle for the company held firm in the third quarter. From July through September, this price stayed above $49,000, signaling resilient consumer demand. The average transaction price per vehicle refers to the average amount a consumer spends when purchasing a car.

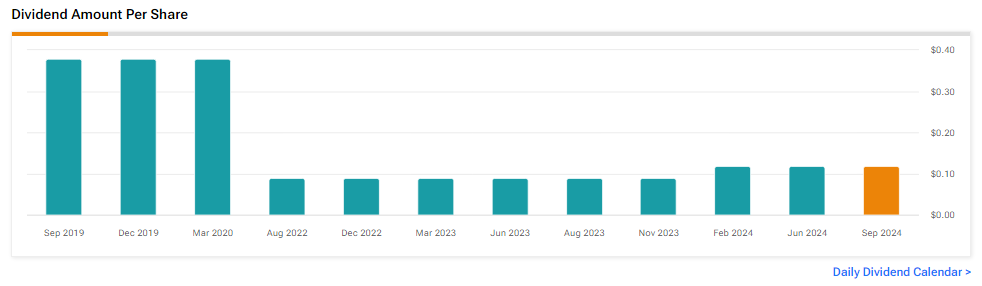

GM Announces Quarterly Dividend

Additionally, the company’s Board of Directors declared a fourth-quarter cash dividend on the company’s common stock of $0.12 per share, payable on December 19 to all common shareholders of record as of the close of trading on December 6, 2024.

GM Raises FY24 Outlook

Looking ahead, GM raised its FY24 outlook and now expects adjusted EBIT to be in the range of $14 billion to $15 billion, compared to its prior guidance of $13 billion to $15 billion. In addition, adjusted earnings are estimated to be in the range of $10 to $10.50 per share, above its previous forecast of $9.50 to $10.50 per share. For reference, analysts were expecting earnings of $9.97 per share.

Is GM a Good Stock to Buy Right Now?

Analysts remain cautiously optimistic about GM stock, with a Moderate Buy consensus rating based on 11 Buys, six Holds, and three Sells. Over the past year, GM has surged by more than 65%, and the average GM price target of $56.11 implies an upside potential of 14.7% from current levels. These analyst ratings are likely to change following GM’s results today.