GlucoTrack (GCTK) stock rocketed higher on Wednesday after the medical device company presented results from a clinical trial at the American Diabetes Association’s (ADA) 85th Scientific Sessions. This study concerned its innovative blood-based continuous glucose monitoring technology and marked the first-in-human trial of the diabetes monitoring device.

TipRanks Cyber Monday Sale

- Claim 60% off TipRanks Premium for data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

GlucoTrack shared that the clinical trial met its primary endpoint and all secondary endpoints, including a Mean Absolute Relative Difference of 7.7%, a 99% data capture rate, and no procedure or device-related serious adverse events. The company said it plans to start a long-term early feasibility study of the device in Q3 2025.

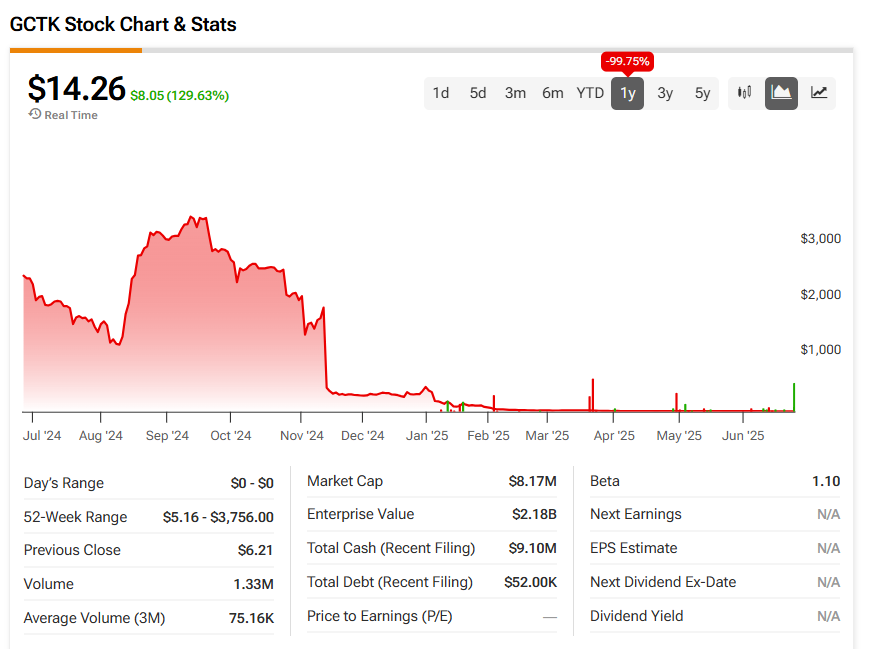

The clinical trial results attracted the attention of traders on Wednesday, who sent shares of GCTK stock 129.63% higher this morning. That’s a welcome change from the stock’s year-to-date fall of 96.8% and 12-month drop of 99.75%. It also came with heavy trading, as 1.33 million shares changed hands, compared to a three-month daily average of 75,160 units.

Is GlucoTrack Stock a Buy, Sell, or Hold?

Wall Street doesn’t offer significant coverage of GlucoTrack stock. Luckily, TipRanks’ AI analyst Spark does. It rates GCTK as an Underperform (28) with no price target. Spark cites “poor financial performance, characterized by a lack of revenue and negative equity” as reasons for the rating.