Shares in semiconductor foundry GlobalFoundries (GFS) fell today even though it was linked with a potential merger with Taiwan’s major chipmaker United Microelectronics to rival industry leader TSMC (TSM).

Don’t Miss TipRanks’ Half-Year Sale

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Global Footprint

According to a report in the Nikkei newspaper, both GFS and United were “exploring” the possibility of a merger. It based this on an assessment plan it had seen. A combined group would, according to the Nikkei report, establish a larger U.S.-based firm with a global manufacturing footprint spanning Asia, the United States and Europe.

The merged company, added the article, would prioritize research and development investments in the U.S. and could “potentially emerge as a viable alternative to TSMC,” the world’s leading chipmaker.

GlobalFoundries stock was over 2% lower in early trading, with TSM down nearly 1%. TSM is eyeing its own massive U.S. expansion. It plans to build new chip plants, packaging sites, and research centers across America to the tune of $165 billion.

U.S. Wants to Get Stronger

One figure who would likely be thrilled by talk of a deal is President Trump. He is seeking to strengthen the semiconductor supply chain in the U.S. amid rising geopolitical tensions in Taiwan and increasing competition from China in the mature chip market.

It could also be a boost to U.S. tech stocks who could benefit from a larger domestic semiconductor foundry to make them less reliant on the Chinese market.

Is GFS a Good Stock to Buy Now?

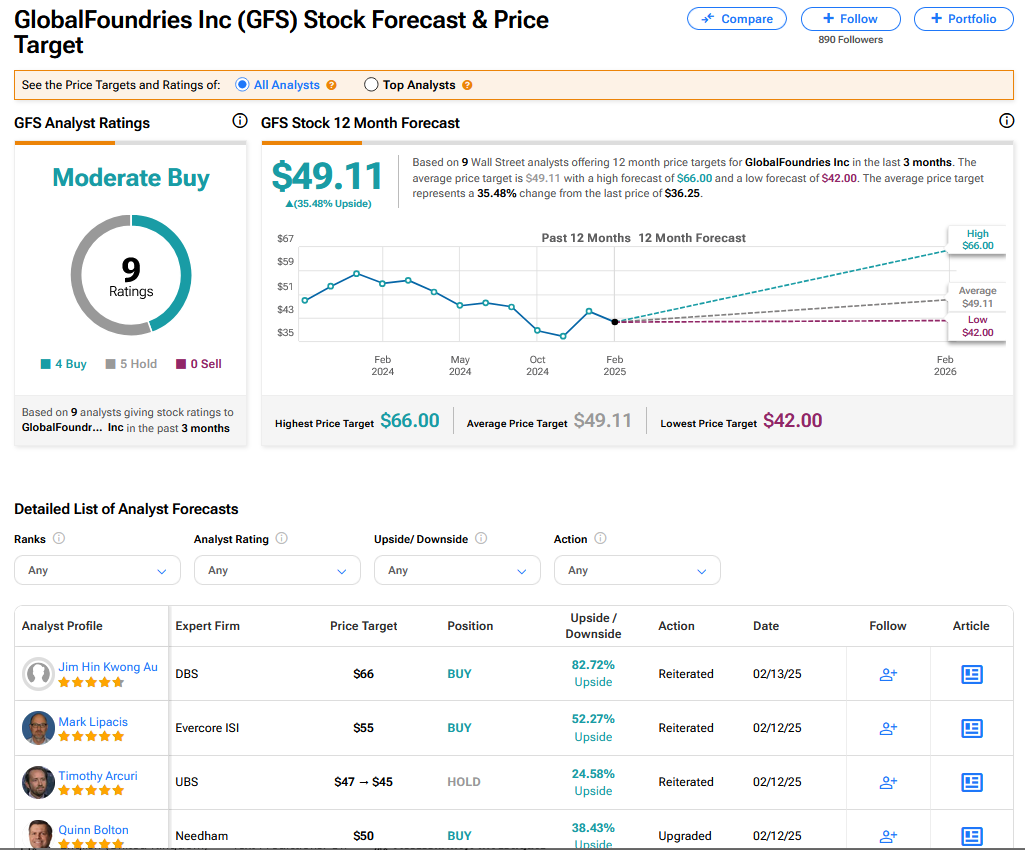

On TipRanks, GFS has a Moderate Buy consensus based on 4 Buy and 5 Hold ratings. Its highest price target is $66. GFS stock’s consensus price target is $49.11 implying an 35.48% upside.