The SGX-listed SATS Limited (SG:S58) garnered an optimistic outlook from analysts after it posted its first-half results for FY24 earlier this month. The company delivered another strong set of quarterly results, driven by continued recovery in air travel demand and better contributions from associates.

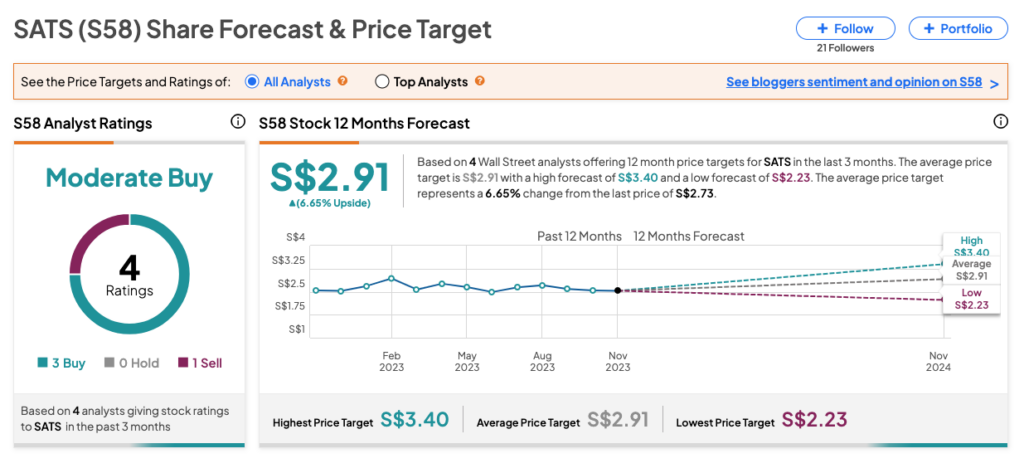

Post-results, analysts from Citi and CGS-CIMB upgraded their ratings from Hold to Buy. On the contrary, Phillip Securities downgraded its recommendation on the stock to Sell and lowered its target price from $2.51 to $2.23. Meanwhile, DBS maintained its Buy rating on the stock, predicting an upside of 25%.

The SATS share price has experienced a growth of over 7% in trading since the release of its first-half results for fiscal year 2024.

SATS is primarily a food services company specializing in catering to the aviation sector. In addition to catering, the company offers a range of services, including aviation security, warehousing, and passenger services.

Analysts’ Opinion

Most recently, analyst Wee Kuang Tay from CGS-CIMB upgraded his rating on the stock from Hold to Buy while raising his price target from S$2.86 to S$3.0. The broker stated in its research report that the company’s solid revenue momentum will drive profitability in the upcoming quarters. He believes the EBIT margins will reach the level of 14.7% in FY25, driven by continued recovery in the aviation industry, which means meals served on flights for SATS.

In its decision to upgrade the stock, CGS CIMB identified the stronger revenue momentum as its re-rating catalyst, which will contribute to positive cash flow and eventually the restart of dividends.

On the flip side, analyst Peggy Mak from Phillip Securities downgraded her rating on the stock to Sell. Mak stated her bullish stance over the company’s food solutions segment, which continues to incur losses despite a recovery in its revenues. She also remained cautious about the higher working capital requirement of the company in light of its acquisition of Worldwide Flight Services (WFS).

Strong Number Game

For the first half of FY24, revenue experienced a threefold increase year on year, surging from S$804.5 million to S$2.5 billion. In the food solutions division, revenue witnessed a notable 28.2% year-on-year climb, reaching S$516.1 million. The company also posted an operating profit of S$75.7 million during this period, marking a significant turnaround from the S$42.3 million loss reported in the previous year.

In terms of operating metrics, the number of flights handled by the company increased by three times, reaching 299,100. Moreover, the number of passengers handled experienced a substantial surge, increasing by nearly 72% to 38.5 million. Meals served witnessed a 50% year-on-year increase, reaching 47.1 million.

Is SATS a Good Stock to Buy?

TipRanks rates S58 stock as Moderate Buy, with three Buy and one Sell recommendations. The SATS share price target is S$2.91, which is 6.6% above the current trading level.