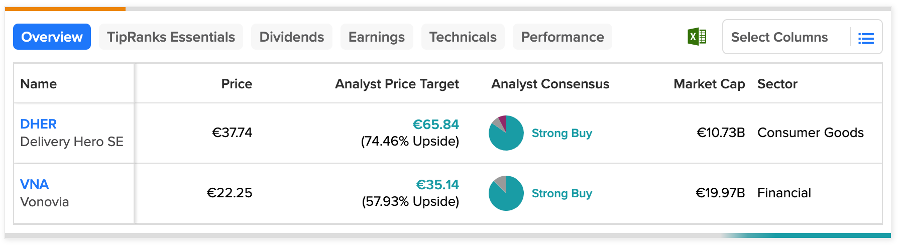

German companies Delivery Hero SE (DE:DHER) and Vonovia (DE:VNA) have more than 50% upside potential in their stock prices. Analysts are looking at the long-term prospects of these companies and believe they will come out of their current downward trend in their share prices.

Both companies have a strong dominant presence in their respective sectors and are well-placed to grow further with the improvement in the economic scenarios.

Let’s have a look at the details.

Vonovia SE

Vonovia is a real estate company with a strong grip on the residential sector in Germany, Austria, and Sweden.

The company’s stock has been trading down by almost 50% in the last year. The shares were mainly hit due to rising mortgage rates and inflation affecting the housing sector. The company operates on a debt-driven model, which was impacted due to higher refinancing costs in the economy.

Analysts believe the stock will remain shaky as long as higher interest rates continue, but they are also bullish on the long-term aspects as soon as rates fall. Until that time, shareholders can enjoy the dividends. The dividend yield of 7% is much higher than the industry average of just 2.1%. This makes it a top pick during recessionary times.

Vonovia will announce its full-year results for 2022 on March 17.

What is Vonovia’s Price Target?

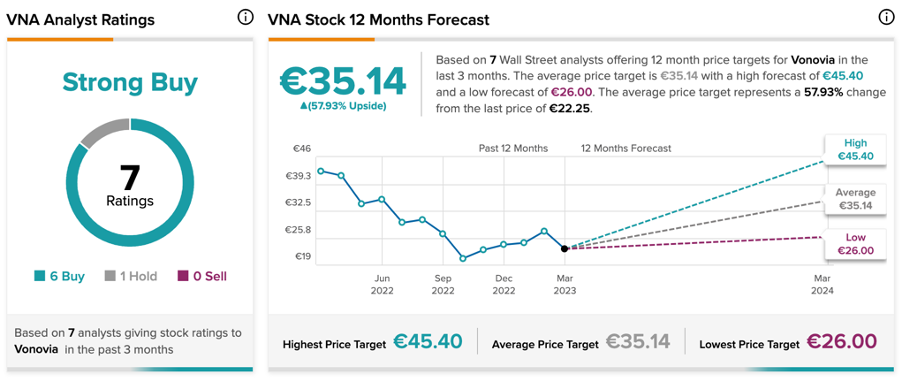

VNA stock has a Strong Buy rating on TipRanks, with six Buy and one Hold recommendations.

The target price of €35.14 implies a huge upside of 58% on the current trading price.

Delivery Hero SE

Delivery Hero is an online food service company with operations in more than 50 countries worldwide.

The company’s stock has also been trading down 16.6% in the last year. The company’s business was largely impacted by the pandemic and lockdowns, which hurt revenues and profitability.

However, the recently released annual results for 2022 depict that the company is on the right track to full recovery. The company’s numbers depicted a revenue growth story along with margin expansion. The group’s GMV (gross merchandise value) increased by 17.5% on a year-over-year basis in 2022. The margin also improved to -0.3% in the fourth quarter as compared to -3.3% in Q4 2021.

One of the major bullish aspects of the company is its geographical diversification with a strong presence in emerging markets. Analysts believe this creates a huge opportunity for the company to tap the food delivery market in these regions with high growth rates.

Is Delivery Hero a Buy?

According to TipRanks’ analyst consensus, DHER stock has a Strong Buy rating, with a total of 13 recommendations.

The target price is €65.84, which implies an upside potential of 74%.

Conclusion

Vonovia is set to recover in the long term after interest rates stabilize in the economy and start to fall. The higher dividend payments are the perfect add-ons during these times.

As for Delivery Hero, analysts feel the company will benefit from its growth in emerging markets, which will support its profitability and share price.

Questions or Comments about the article? Write to editor@tipranks.com