Among the key news on UK stocks, FTSE 250-listed PageGroup PLC (GB:PAGE) shares tumbled after the company issued a profit warning for 2024, as the hiring slowdown continues in most of its markets. The company now expects its full-year operating profit to fall to around £60 million from £118.8 million in 2023. Following the update, PAGE stock fell 6.7% as of writing.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

PageGroup is a UK-based recruitment firm offering services across 37 countries globally.

PageGroup’s Q2 2024 Trading Update

In the second quarter, PageGroup’s gross profit fell by 12% year-over-year to £224.3 million on a constant currency basis. Regionally, Asia Pacific was hit the hardest with an almost 20% drop in gross profit, followed by the UK at a decline of 17.4%. Americas faced a decrease of 6.6%, while EMEA’s gross profit was down by 10.2%.

Among PageGroup’s segments, temporary recruitment was better than permanent recruitment in Q2, with a 9.8% decline compared to a 12.8% decline in permanent placements, as clients opted for more flexible solutions.

The company further mentioned that clients maintain a cautious approach to new hiring, while employees are reluctant to switch jobs due to tougher economic conditions. It added that even though salary levels are strong, the volume of offers is below the levels witnessed in 2022 and 2023.

Moving forward, PageGroup sees no signs of improvement across its markets as clients have tightened their recruitment budgets, resulting in a slow hiring process.

The company will publish its first-half results of 2024 on August 8.

Is PageGroup a Buy or Sell?

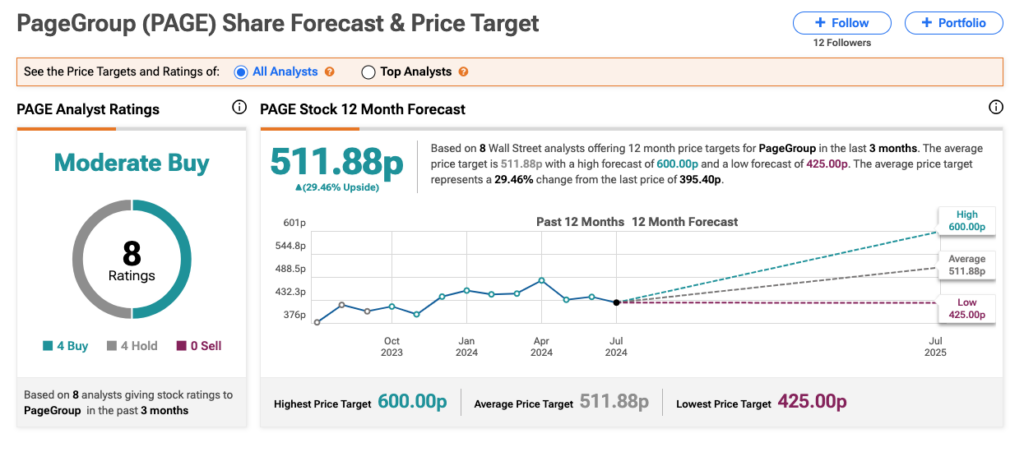

According to TipRanks’ consensus, PAGE stock has received a Moderate Buy rating based on four Hold and four Buy recommendations. The PageGroup share price forecast is 511.88p, which is 29.5% above the current trading level.