In major news on UK stocks, JD Sports Fashion PLC (GB:JD) announced the acquisition of its American rival Hibbett Sports (NASDAQ:HIBB) for an equity value of $1.08 billion, in a move to expand in the U.S. market. The company emphasized that the acquisition will accelerate its expansion efforts in North America while also strengthening its foothold in the world’s largest and most profitable sportswear market. JD Sports shares have gained over 6% as of writing. Meanwhile, HIBB stock was up nearly 19% in the pre-market session in the U.S.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

JD Sports Fashion specializes in retailing branded sportswear and fashionwear. Meanwhile, Hibbett is a prominent sports fashion-inspired retailer based out of Alabama, with a presence in communities across 36 states in the U.S.

Potential Benefits for JD Sports in Hibbett Acquisition

After this deal, the combined revenues of JD Sports and Hibbett in North America would be roughly £4.7 billion. Consequently, this deal will increase the combined company’s North American region’s contribution to total sales from approximately 32% to around 40%. The deal will further enhance JD’s Complementary Concepts division and partnerships with additional brands.

As per the agreement, JD Sports will pay $87.50 per share in cash, marking a premium of roughly 20% over Hibbett’s recent closing price. The company is funding the deal and also refinancing Hibbett’s debt via its current U.S. cash reserves of $300 million and a $1.0 billion extension to its current bank facilities.

The transaction is anticipated to be finalized in the second half of 2024, depending upon approvals and clearances.

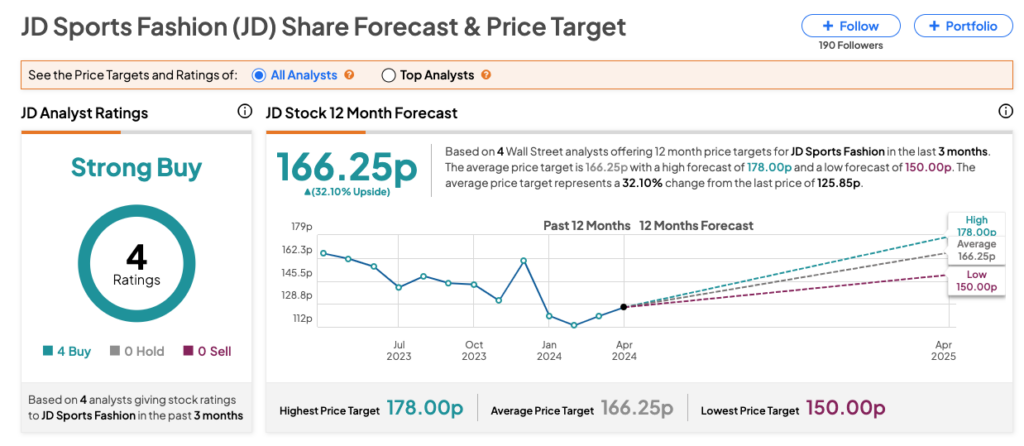

Are JD Shares a Buy?

Year-to-date, JD stock is down by 21%, mainly hit by a single-day loss of 23% in January after the company issued a profit warning for FY24. The company revised its full-year profit before tax and adjusted items guidance for 2024 to the range of £915 million to £935 million, down from the previous expectation of £1 billion. However, analysts still maintain a bullish stance on the stock.

On TipRanks, JD stock has received a Strong Buy rating, backed by Buy recommendations from all four analysts covering the stock. The JD Sports share price prediction is 166.25p, which is 32% above the current level.