The UK-based travel technology company Trainline PLC (GB:TRN) and media group M&C Saatchi (GB:SAA) reported their half-yearly numbers yesterday. Trainline released trading update for the first half of FY24, revealing increased revenues that pushed its share price up by 10.5%. Conversely, M&C Saatchi announced half-year losses, causing a 1.15% drop in its share value.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The TipRanks Earnings Calendar offers a valuable tool for identifying companies that have recently disclosed their financial results as well as those scheduled for upcoming earnings releases. Investors can delve deeper into these stocks for additional research, enriching their decision-making process. The tool is now available for nine different markets.

Let’s take a look at the numbers.

M&C Saatchi PLC

M&C Saatchi is a communications company known for its creative expertise in the complete digital landscape. The company has operations in 23 countries worldwide.

The company announced its half-year earnings report, including the second-quarter numbers for FY23. The company reported a statutory pre-tax loss of £5.1 million, as compared to £0.3 million profits in the previous year. The group’s total revenue was also down by 7% to £120.4 million, impacted by a less favourable economic environment leading to reduced client spending, especially in the technology sector. Among its segments, Media Specialism saw a 30.1% decline in its revenues, and the Advertising division was down by 16.1%.

The company anticipates improved performance in the second half of FY23, with only a small single-digit decline in net revenue expected. The company has already secured 85% of its expected full-year revenues.

YTD, the M&C Saatchi share price has been trading down by 13.8%.

Trainline PLC

Trainline PLC is a technology company that owns an independent platform for rail and coach travel and sells tickets to millions of customers worldwide.

The company announced its trading update for the first half of fiscal year 2024 ahead of its earnings report in November 2023. The numbers depicted strong growth for the company, with higher ticket sales and revenues for the six months that ended on August 31, 2023. The net ticket sales for the group increased by 23% on a year-over-year basis to £2.6 billion. The company achieved revenues of £197 million, marking 19% growth compared to the first half of FY23. The overall growth in numbers represented the ongoing recovery in the rail industry, with passenger volumes reaching pre-COVID levels.

The company also confirmed its guidance numbers for the full fiscal year 2024. It expects net ticket sales to grow between 13% and 22%. Also, the adjusted EBITDA is expected to be between 2.15% and 2.25% of the net ticket sales.

Is Trainline a Good Buy?

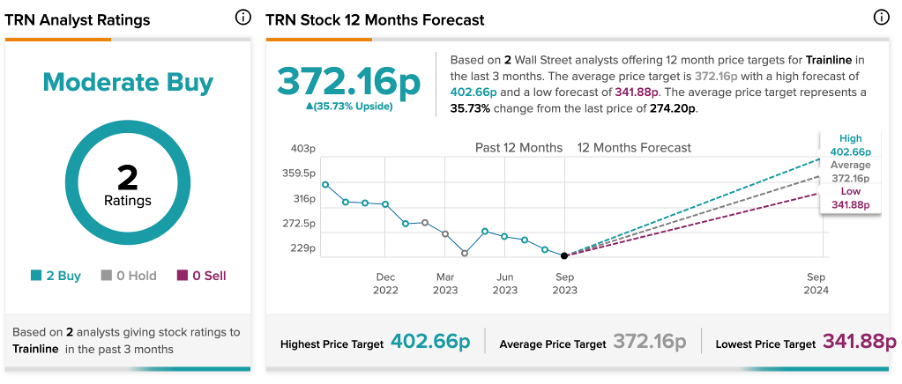

TRN stock has been assigned a Moderate Buy rating on TipRanks, based on two Buy recommendations. Nevertheless, these ratings may undergo changes following the positive numbers in the trading update.

The Trainline share price target is 372.16p, which implies an upside of 35.7% on the current trading price.