SGX-listed companies United Overseas Bank (SG:U11) and StarHub Ltd. (SG:CC3) will report their first quarterly earnings for 2023 on May 4.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

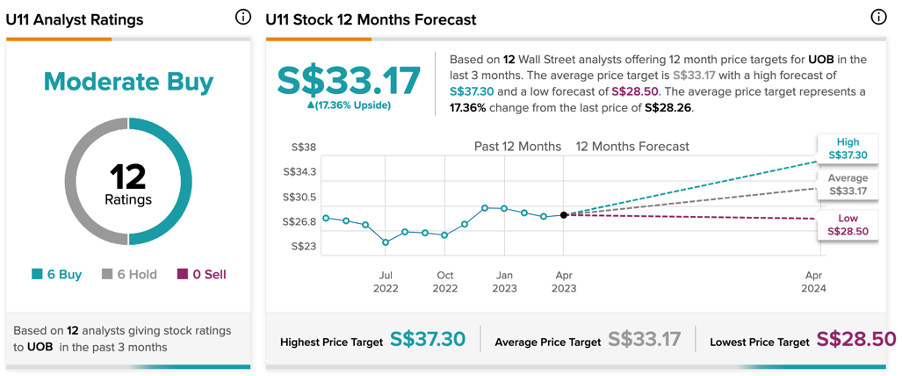

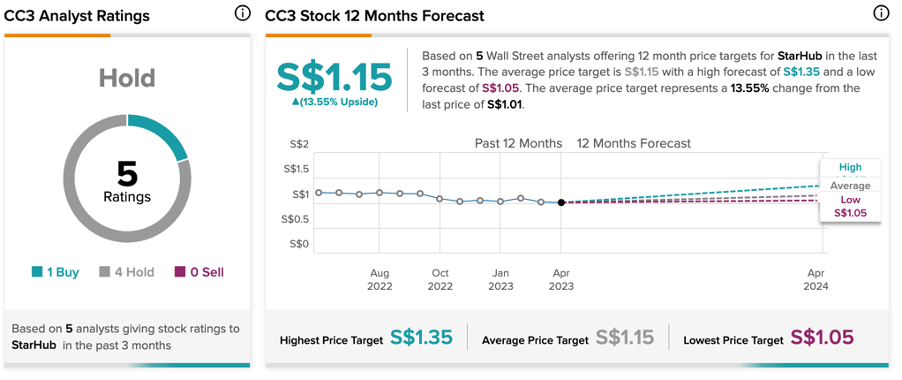

Prior to their respective announcements, UOB had been given a Moderate Buy rating by analysts, whereas StarHub had been assigned a Hold rating. According to analysts, both stocks are expected to see more than a 15% increase in their share prices.

Let’s take a look at these companies in detail.

United Overseas Bank (UOB)

UOB is a Singapore-based multinational banking corporation that offers a diverse selection of banking and financial planning products. The bank’s primary focus is on Asian markets.

UOB is set to release its Q1 2023 earnings report with an anticipated EPS of S$0.9. This figure represents a significant increase from the EPS of S$0.54 reported during the corresponding period in 2022.

Recently, the bank published its trading update for the first quarter, and the numbers did not disappoint investors. The lender experienced growth across its wholesale, global markets, and retail divisions, leading to a new record-high core net profit of S$1.6 billion. During the quarter, the bank experienced a 56 basis point expansion in its net interest margin, which resulted in a 43% increase in net interest income of S$2.4 billion. This helped offset the negative growth in loans as big companies reduced their borrowings.

Moving forward in 2023, the bank remains highly optimistic on Asian markets and is well-placed to capitalize on the region’s economic rebound this year, given its robust balance sheet.

What is the Target Price for UOB?

Based on six Buy and six Hold recommendations, the rating consensus for U11 stock on TipRanks is Moderate Buy. The average price target is S$33.17, with an upside potential of almost 17.4%.

StarHub Limited

StarHub is a Singapore-based telecom company that provides first-rate communication, entertainment, and digital solutions.

The company will report its Q1 2023 earnings on May 4. According to TipRanks, the consensus EPS forecast is S$0.02. The sales forecast for the quarter is S$564 million, down from the previous quarter’s sales of S$1.27 billion. The company anticipates service revenue growth of 8% to 10% in 2023.

Overall, analysts have a Neutral tone on the stock as they expect the company to push bottom-line growth in the mid-to-long term.

What is the Price Target for StarHub?

According to TipRanks, CC3 stock has a Hold rating based on one Buy versus four Hold recommendations.

The average price prediction for the stock is S$1.15, which is 13.5% higher than the current price level. The target price ranges from a low of S$1.05 to a high of S$1.35.

Conclusion

While analysts are optimistic about UOB’s results due to increased interest income and a stronger balance sheet, they are less upbeat about StarHub’s prospects, as the company is predicted to experience a drop in both sales and profits for the quarter. Nonetheless, StarHub maintains a positive outlook for its full-year figures in 2023.